Has President Donald Trump bitten off more than he can chew? Wilbur Ross, the secretary of Commerce during Trump’s first term, certainly thinks so, as he explained in an exclusive interview with us on Wednesday, shortly before Trump announced a 90-day pause on his plan to impose punitive sanctions on America’s trading partners. (This interview has been condensed and edited for clarity.)

What do you make of this current situation?

Well, it’s not precisely what I would have recommended, but I think that’s less important than the question of why we are where we are. How do we get out of this? I think the way to have markets regain stability and people get out of their fright would be to pick a particular country out of the 50 or 60 or 70 that are involved here and quickly make a deal with them that makes sense.

How do we get there?

You obviously can’t negotiate simultaneously with that many nations. We don’t have the bandwidth to do it. Even if you assume that they had a preset plan where they want to come out with each country—which I doubt—it’s very hard to negotiate simultaneously with that many. It would be best if he picked a test case and brought it to a reasonable conclusion quickly.

Was trade so unfair that these tariffs were necessary?

I think it was necessary to make some changes, yes. And I think it was necessary to do them on a broad basis. I think a more moderate baseline, like the 10% baseline, that’s a good idea. 10% is pretty much absorbable, so it would start the process. But what I would have preferred to see would be in addition to the 10%, he’d just pick for the moment one or two of what he feels are the most egregious ones and hit them with a big number and try to bring that to a conclusion and then go on to the next one. Putting high tariffs on a very large number of countries all at once is counterproductive if your real aim is lowering tariffs, because of the bandwidth problem.

Who ultimately benefits from this current situation?

Well, leaving out the island with penguins and seals, what’s really important is Japan, Vietnam, all those. And I can understand to some degree his strategy of isolating China. That probably is not such a bad strategy, but he hasn’t really just isolated China. He’s also isolated Vietnam and quite a few others. If this were to hold, there would be a massive transfer of wealth from Asia to Latin America because the Latin American countries are much lower in the tariff scale than Asia, and yet their wage rates in many cases are pretty comparable effectively when you allow for currency and all that. So I don’t know if that was an intended consequence, but certainly Latin America would be a relative winner if these rates, or anything like them, are sustained.

Had you been in your position this term, what would you have told Trump?

Well, I like the idea of a modest global tariff because 10% is absorbable without big inflationary problems here, and it doesn’t really change the relative mix country by country. Where I would have been more cautionary would be going to some of the extremes. You put a 40% or 50% tariff on everything, and you’re really telling that country, “I don’t want to do business with you.” So I think it’s the wrong message.

And they don’t come back, do they?

He will get some concessions. The question is, will a reasonable middle ground be struck where he gets enough concessions that things stabilize quickly? The other countries, without question, will make some concessions. They have to. There isn’t one of them that can afford to go forward without the U.S. If the spirit really is compromise, that would be fine and would achieve his objective.

Because to me, he has a couple of objectives. He likes the idea of more revenues coming in, and he likes lowering trade deficit. Well, those are, in a sense, antithetical, in that the higher the tariffs you have on, the less you’re going to succeed with collecting revenue, because those countries will just stop shipping to you. So he’s got to get a balance. And assuming that he recognizes that, and is heading that way, I think it could work out fine.

Watch Big Business This Week on Cheddar—and YouTube!

Trumplandia

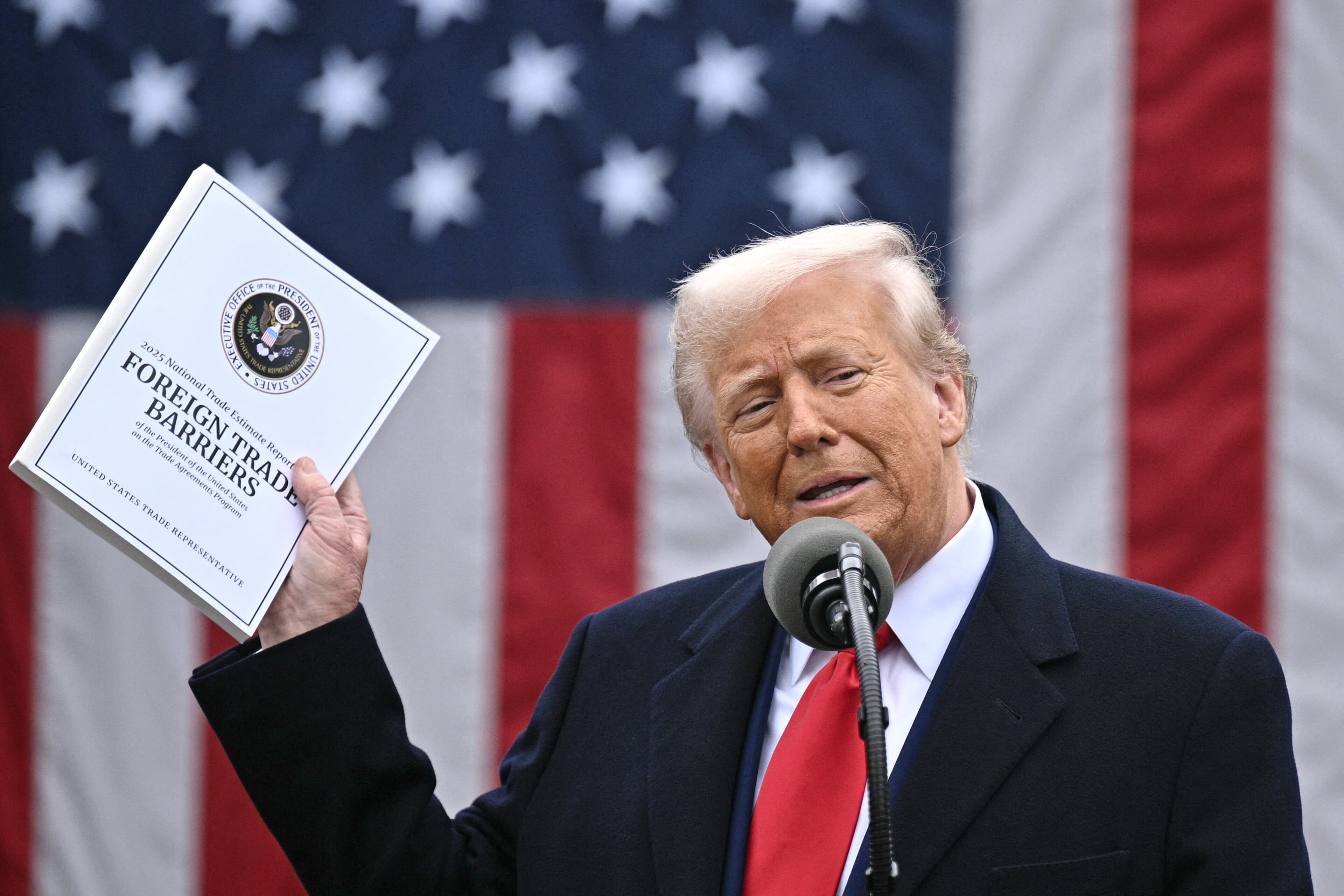

As Trump carried through with his threat to impose tariffs on America’s trading partners last week, the markets began a weeklong descent, with the Dow down 10.85% from April 2 through April 8.

Then things got weird: Trump said he’d postpone most of the tariffs for 90 days, but said he’d slap tariffs of 145% on China, and keep a minimum 10% tariff on all imports and 25% on cars and car parts. (At least that was his stance at press time on April 10.) The Dow rose 7.87% on Wednesday before diving again on Thursday, down 4.25% by noon. Not even an optimistic inflation report on Thursday could help the market. The Consumer Price Index climbed 2.4% in March from a year earlier, and below February’s 2.8% hike. Core inflation, which strips out volatile food and energy items, dropped to 2.8% in March. But it’s the tariffs that count now. “We don’t see tariffs as a one-time price shock. We see them as having significant second-round effects,” said James Egelhof, chief U.S. economist at BNP Paribas, told The New York Times.

Just the threat of tariffs is beginning to upend the global economy, and China is already looking for new places to sell its goods, meaning U.S. prices are likely to rise. China has refused to back down, raising tariffs on U.S. goods there to 84%, and relishing the idea of dethroning the U.S. as the world’s commercial and financial capital.

Tariffs will bring on an “economic nuclear winter,” warned Trump acolyte and Herbalife shortseller Bill Ackman. “By placing massive and disproportionate tariffs on our friends and our enemies alike and thereby launching a global economic war against the whole world at once, we are in the process of destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital,” Ackman wrote in one of those long posts on X.

Meanwhile, someone’s been making book on the volatility, and not just people trading volatility indexes. That 90-day suspension, which followed repeated White House denials that a suspension was imminent, has raised suspicions.

Senators Adam Schiff and Ruben Gallego want to know why Trump posted a note on his Truth Social platform after his tariff announcement tanked the markets, but shortly before he decided that he’d take a 90-day break. “This sequence of events raises grave legal and ethics concerns. The President, his family, and his advisors are uniquely positioned to be privy to and take advantage of non-public information to inform their investment decisions,” the senators said in a letter to Trump’s chief of staff, Susie Wiles, and Trade Representative Jamieson Greer on Thursday, asking for an investigation into potential conflicts of interest.

“THIS IS A GREAT TIME TO BUY!!! DJT,” Trump wrote on Truth Social at 9:37 a.m., the AP reported. Around 1 p.m. ET, Trump announced a 90-day pause on nearly all his tariffs. The S&P 500 gained back about $4 trillion, or 70%, of the value it had lost over the previous four trading days.

“The people who bought when they saw that post made a lot of money,” said Trump critic and former White House ethics lawyer Richard Painter. Was Trump already contemplating the tariff pause when he made that post? Asked about when he arrived at his decision, Trump gave a muddled answer, AP reported. “I would say this morning,” he said. “Over the last few days, I’ve been thinking about it.” He then added, “Fairly early this morning.”

Then there’s the question of Monday’s micro-rally and mega-dip, and whether that’s related to Thursday’s climb. On Monday, both CNBC and Reuters reported a claim on social media that Trump’s economic adviser, Kevin Hassett, had said the tariffs would be stayed for 90 days. That news, and the original X post itself, sent a cratering S&P 500 index back up about 6% before the original post came down and Hassett denied the report.

Bill Ackman had this to say:

- Bond, safe bond: The U.S. dollar and the yields an investor could expect from safe but boring U.S. Treasury bonds are a good part of what has kept the United States — and the dollar—the world’s financial safe haven. But this week, the bond market bobbed in the wake of Trump’s tariff pronouncements, and yields showed that faith is ebbing in U.S. Treasuries and the U.S. dollar. Basically, the higher the interest rate that a seller has to offer to induce someone to buy a bond, the greater the indication that the prospective buyer thinks the bond will have less purchasing power when it finally matures. When the tariffs went into effect, including levies of more than 100 percent on China, the yield on the 10-year U.S. Treasury rose to as high as 4.5 percent, up from around 3.9 percent a few days ago. The yield on a 30-year bond briefly traded above 5 percent. “The global safe-haven status is in question,” Priya Misra, a portfolio manager at J.P. Morgan Asset Management, told the New York Times. “Disorderly moves have happened this week because there is no safe place to hide.”

- Amazon, but for human beings: Acting Immigration and Customs Enforcement director Todd Lyons said he envisions squads of trucks rounding up immigrants for deportation the same way that Amazon trucks crisscross America delivering packages. “We need to get better at treating this like a business,” Lyons said at the 2025 Border Security Expo at the Phoenix Convention Center, explaining he wants to see a deportation process “like (Amazon) Prime, but with human beings.”

- Canalman’s plan in trouble: Donald Trump’s plan to have U.S. asset manager BlackRock buy control of two Chinese-operated ports at either end of the Panama Canal appears to have hit a closed lock. Panama’s government auditor said the Hong Kong–based company, CK Hutchison, owes the government $300 million. And may have illegally won a 25-year extension to operate the port. An April 2 deadline for closing the BlackRock deal passed with no announcements.

- Viewing in interesting times: Trump’s supercharged economic pendulum has been great for TV business channels. Fox Business’s daytime viewership was up 25% last week over the week before, and CNBC saw its viewership zoom up 75% on Monday compared with its post-election weekday average.

- Catch me if you can: The IRS’s audit rate of individual taxpayers has dropped by about two-thirds since 2010 and now sits at about 0.36% of all personal tax returns, according to a New York Times analysis of agency data. That number may shrink if Trump lays off more IRS auditors. Al Capone must be envious.

Want to get smarter about financial markets?

Join 200,000 investors who get Opening Bell Daily in their inbox — it’s packed with Wall Street data, charts and analysis you won’t find anywhere else. Subscribe free.

The Usual Suspects

- Dimon in the rough: Is JPMorganChase CEO Jamie Dimon changing his tune? In his annual letter to shareholders, Dimon warned, “The recent tariffs will likely increase inflation and are causing many to consider a greater probability of a recession.” Strong words from the most powerful financier in America. But just a couple of months ago, Dimon was reading from a different hymnal. Asked whether Trump’s then-planned tariffs would ignite a deadly trade war that could ravage the U.S. economy, Dimon replied: “If it’s a little inflationary, but it’s good for national security, so be it. I mean, get over it,” Dimon told CNBC at the World Economic Forum in Davos, Switzerland. “National security trumps a little bit more inflation.”

- Star Wars: The Amazon Strikes Back: Jeff Bezos’ Amazon is set to begin launching its Kuiper satellite-based internet service, named for a distant belt of icy asteroids at the edge of our solar system and intended to compete with Elon Musk’s Starlink network. A first commercial launch on a Lockheed-Boeing rocket from NASA’s Cape Canaveral was scrapped this week by bad weather, but Amazon says it will start service later this year with 578 satellites, and will eventually offer global coverage to rival that of Starlink, with 3,200 satellites over the next few years. Starlink has 7,000 satellites and aims to have 12,000 by the end of 2026.

- The Minecraft goldmine: Maybe 7-year-olds know something we don’t. The Warner Bros. Discovery film A Minecraft Movie was apparently the hit Hollywood needed this year, with a $157 million opening weekend box office in the U.S. and Canada. That’s the biggest since Marvel’s Deadpool & Wolverine last summer. The movie is based on the Microsoft video game that has my second-grade son captivated; he loved it. I’ll refrain from passing judgment. But the WBD studio has been under pressure to produce a hit since last year’s inconceivably awful box office flop of a musical, “Joker: Folie a Deux,” with Joaquin Phoenix and Lady Gaga.

- It’s epic: Universal’s Epic Universe in Orlando, the first major new theme park to open in Central Florida in 26 years, may help the studio take a bigger chunk of Orlando’s $92.5 billion annual tourism economy from DisneyWorld. The New York Times calls the $7 billion, 100-acre park an interactive “reflection of consumer obsession with instant gratification and personalization.”

Get Big Business This Week in your inbox every week—and read it before everybody else! Sign up today.

Elon’s World

- Name-calling: Musk called Trump’s top trade adviser, Peter Navarro, “a moron” and “dumber than a sack of bricks,” for his tariff plans, which threaten to upend Musk’s own businesses. The day before, Navarro called Musk a “car assembler,” not a “car maker,” because Teslas use parts from around the world. Musk called Navarro “Peter Retardo.” Navarro came to Trump’s attention with a book he wrote about how tariffs would restore America’s greatness. He often cited an economics expert named Ron Vara, which is an anagram of his own name.

- Wanna buy a used Tesla? All those people selling their Teslas because they dislike Elon Musk (or because Trump’s cuts mean the government is no longer seeding the development of charging stations) are good business for car dealers who fear Trump’s tariffs will push new cars—foreign and domestic—out of range of most buyers. The New York Times reports that a $4,000 federal tax credit for electric cars under $25,000 means you can buy a used Model 3 for well under $20,000.

The Short Stack

- The first to go: This time it’s the consultants. As the U.S. government tells consulting firms to slash the cost of their contracts, Deloitte, one of the largest consultants to the federal government, says it’s sacking its own employees. No word on how many people will be cut from the firm’s 173,000-strong workforce, but the move comes after revenue stalled, growing less than 1% in 2024, after a hike of 17.8% in 2023, and 25.5% in 2022.

- Sharp move: Harry’s Razors, the men’s shaving startup whose close-cutting triple-blade razors, with blades made in Germany, is becoming its own consumer products conglomerate. After a planned $1.37 billion sale to the parent of Schick and Wilkinson was torpedoed by antitrust regulators, the company is rebranding itself as Mammoth Brands and expanding into deodorants, soap and acquisitions. It’s still got a long way to go. While it’s the second-best-selling razor brand in the U.S. behind Gillette, Harry’s only had revenue of $835 last year. Gillette parent Procter & Gamble had revenue of $84 billion.

- Proof that bunnies don’t lay eggs: Just in time for Easter, the price of a dozen eggs reached a new high of $6.23 in March. That came despite a drop in wholesale costs and no new bird flu outbreaks at egg farms. A dozen eggs sold for $4.95 in January and $5.90 in February, according to the U.S. Bureau of Labor Statistics. President Trump, who campaigned on lowering the price of groceries including eggs, had promised costs would drop for consumers. The USDA predicts the price of eggs will rise by more than 40% in 2025.

- Big law sues back: Two of the major law firms that Trump attacked have filed suit to block his executive orders, which call the firms a national security risk and could bar their attorneys from representing companies with government contracts—or even bar them from entering federal courthouses. Jenner & Block and WilmerHale say Trump’s orders violate their First Amendment rights.

- Going, going… The global art market shrank by 12% in 2024 to an estimated $57.5 billion, even as the number of art objects sold rose by 3% to 40.5 million. That’s bad news for the world’s auction houses, which make their money from selling high-end masterworks for tens of millions of dollars. Auction sales of single works for more than $10 million fell by 39%. Still, the big-name venues made up for some of that with with private sales by auction houses rising 14% over 2023, according to the Art Basel and UBS Art Market Report.

- It looks gorgeous on you: Italian luxury fashion house Prada has agreed to buy struggling design shop Versace for $1.38 billion, a far cry from the $2.1 billion that conglomerate Capri, which also owns Jimmy Choo and Michael Kors, paid for Versace in 2018. Luxury fashion is a risky business, as consumer tastes can swiftly change. And then there are the regulators. Capri failed to sell itself to Coach owner Tapestry for $8.5 billion in 2023, after the Federal Trade Commission said that would stifle competition in the market of affordable luxury handbags. Stick that in your Birkin.

Farewell, Quartz

Late last week, almost without anyone noticing, the carcass of one of the great news sites of the internet age was thrown to the wolves. Quartz, launched in 2012, was sold to its fifth owner in less than a decade, and the skeleton staff of about a dozen reporters and editors were fired (they reportedly got severance and three months’ healthcare). According to media reports, the new owners, a Canadian software company called Redbrick, bought Quartz for its mailing lists—it claimed over 1 million opt-in subscribers for newsletters covering everything from space and management to a weekly column I wrote until January, taking a deep dive into timely questions of business and economics.

It began with a few escapees from the Wall Street Journal, led by a brilliant journalist named Kevin Delaney, who came up with an idea for a business news website that would break the boring traditions of business news, embodied then by the Wall Street Journal and Bloomberg News —and even CNBC—whose snoozable content drew a wealthy but aging readership.

Without Quartz, it’s fair to say, there’d be no Cheddar. Quartz was first on the scene to cover financial news in a young and savvy way, making the business and the economy interesting to new audiences. It aimed high, and for a while it succeeded. But it seems, as one colleague put it, that it’s the destiny of websites these days to aim high, start off with a bang, and do great work, only to end up being sold for dog food. Or—as Stephen Carter, CEO of Informa, the conference-hosting company that bought one of my previous employers, Industry Dive, put it—as a “great source of first-party data.” In other words, people to whom you can sell stuff. That’s certainly what happened with Quartz. In 2022, Jim Spanfeller, an opportunistic venture capitalist, acquired Quartz and a raft of other flailing online news sites, including Gawker and The Onion, that he swiftly sold off or folded, one by one.

Maybe it had to be this way. As former Quartz publisher Zach Seward wrote this week, Quartz never made money. “We grew, between 2012 and 2018, to nearly 250 employees and $35 million in annual revenue. The dismal economics of digital media meant losing more than $40 million over that stretch just to grow unsustainably large.”

By 2018, Quartz was a mammoth, with editions in Europe, India and Africa, but its key revenue source—beautifully produced and perfectly integrated branded content, sometimes indistinguishable from the news content—began to dry up. Many of the better reporters and editors drifted away, and its news content became less exciting and less appealing. The problem was money. Quartz became so unsustainable, in fact, that owner David Bradley, who also owned the Atlantic, sold it to another news site I’d been working for, a Japanese financial information outfit called Uzabase, which tried breaking into the U.S. with a news curation app called Newspicks. Its young, T-shirted CEO, Yusuke Umeda, paid $86 million for Quartz. But that failed, too, and Seward bought it back from Uzabase for a dollar in 2020. Two years later, at the end of the pandemic and with a staff of 80, Seward sold Quartz to Spanfeller, and now three years after that, Quartz has become that a zombie.

Farewell then, Quartz. We knew you when.

Peter S. Green is a veteran reporter and editor who has spent more than two decades covering business and finance from Eastern Europe to New York City, and has worked for Bloomberg News, The New York Post, The New York Times and The Messenger. He lives in New York City and is always looking for the next big story.