Three Cheers for the Nepo-Moguls!

Skydance Media is ready to wed Paramount. Skydance, the movie studio created by David Ellison, whose dad, Larry, is the gazillionaire founder of software giant Oracle, has reportedly agreed to pay $1.75 Billion for control of National Amusements, Inc., the holding company of Shari Redstone, whose dad, Sumner, used the one-time movie theater business to acquire CBS, Viacom, Paramount, MTV, and a host of other media properties. National Amusements will refer the deal to a special committee of Paramount directors for review, The Wall Street Journal reported, citing a source with knowledge of the proposed deal. Talks between the two were nearly complete when they collapsed last month.

This time, the sources tell the Journal, terms include a higher valuation for National Amusements, and more guarantees indemnifying Redstone against shareholders who could sue, charging they got shortchanged in the deal. (Redstone still has 45 days to find a better offer.) Paramount lost $554 million in Q1, has more than $14 billion in debt, and desperately needs cash. The terms of the Skydance offer haven’t been made public yet, but last time they courted, the deal included a cash injection and an offer to buy $4.5 billion of Paramount’s non-voting shares at $15, while Redstone would get $23 each for her voting shares. Skydance is partnering with private equity firm KKR and Redbird Capital Partners.

In a sign of Paramount’s perilous financial state, the company said it’s selling Black Entertainment Television to BET’s CEO, Scott Mills, and a New York–based private equity firm, CC Capital, for $1.6 billion to $1.7 billion. News of the Skydance deal came just a day after news broke that former Paramount CEO Barry Diller and his InterActive Corp were also considering a bid for Paramount.

The Usual Suspects

- Forgiveness Granted, for the Moment: Federal judges temporarily restored President Biden’s student loan forgiveness program while Republican legal challenges work their way through the courts. Meanwhile, nearly half of student loan borrowers aren’t paying their share of the $1.6 trillion debt mountain.

- The Great Cage Match Continues: After a year, Mark Zuckerberg’s Twitter wannabe, Threads, just hit 175 million monthly active users. The Social Media Platform Formerly Known as Twitter hasn’t released any user data since Elon Musk bought it in 2022, but a recent report suggests usage is down 30% in the past year. (Musk famously failed to follow through on his invitation to take on Zuckerberg in a cage fight.)

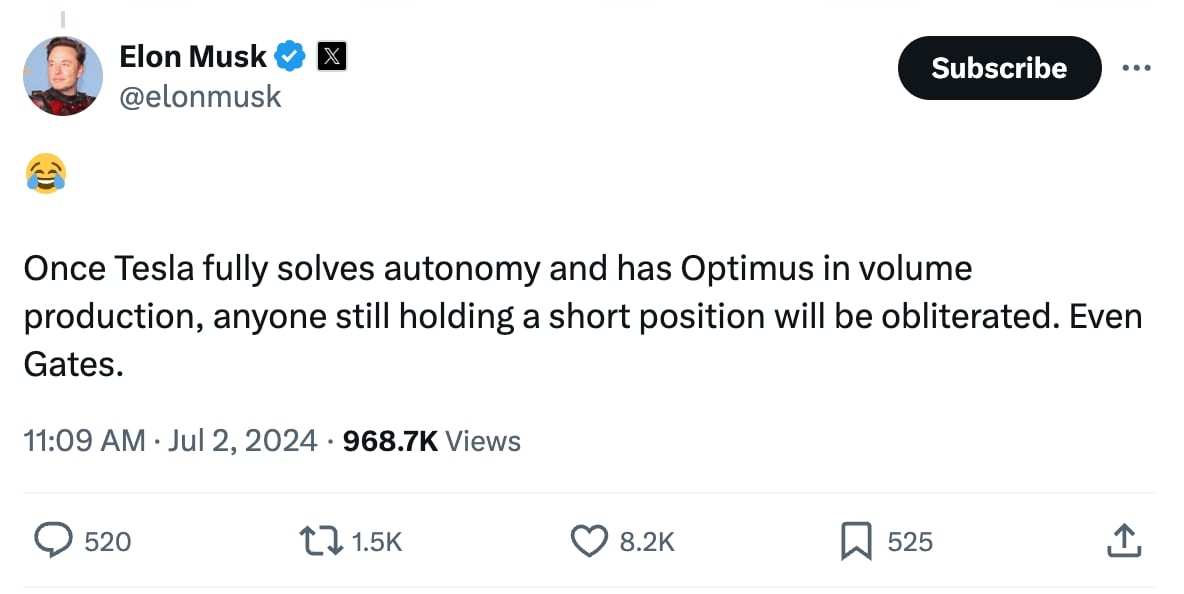

- Elon’s World, Where Down Is Up: On Tuesday, Tesla reported global sales fell 4.8% in Q2 from 2023, after an 8.5% drop in Q1. Still, the less-worse-than-expected results sent the stock up nearly 5% in midday trading Wednesday. Three reasons sales may be down? Elon, Elon, and Elon. The New York Times polled car buyers and auto industry analysts to find that Musk’s right-wing “public persona” has driven away lefties, who are the most likely to buy EVs, and soured analysts on his ability to run the company. Analysts told the Times that Musk’s “image as an erratic, impulsive manager appears to have rubbed off on the cars, raising doubts in some people’s minds about their quality.” Meanwhile, Elon seems to be revving up for cage bout with Bill Gates, saying in a post on TSMPFKaT he’d “obliterate” the Microsoft founder if he doesn’t stop shorting Tesla.

- Interest Rates, Chapter 6207: Fed Chair Jerome Powell says he sees “real progress” in bringing down prices, adding that inflation “now shows signs of resuming its disinflationary trend.”

- Where’s All the Hubbub, Bub? Some $500 million in CHIPS Act money is going to support fledgling tech hubs off the beaten track—in Montana, central Indiana, South Florida and Upstate New York.

- A.I. Bubble? What A.I. Bubble? Investors poured $27.1 billion into A.I. startups from April to June, nearly half the $56 billion in U.S. startup financing in the period, according to Pitchbook.

- Queen-Size Is Good Enough: Mattress Firm (previously known as Sleepy’s) can’t merge with mattress maker Tempur Sealy, the Federal Trade Commission ruled, because the deal would give the mattress maker an incentive to suppress competition and raise prices.

Boeing Boeing Boing!

Faced with massive quality control issues, Boeing has sealed a deal to buy Spirit AeroSytems—which makes the fuselage for the 737 Max in Wichita, Kansas, and which Boeing spun off in 2005—and take the company back under its wing, where it will try to improve safety and quality. The deal will see Spirit shareholders swap their stock for about $4.7 billion of Boeing’s; including Spirit’s debt, the deal is worth $8.3 billion.

Meanwhile, the Justice Department says Boeing can avoid a criminal trial over the crashes in 2018 and 2019 of two 737 Max airliners that together killed 346 people. But the airline will have to plead guilty to charges of conspiring to defraud the Federal Aviation Administration, pay a $244 million fine, invest in safety improvements and be monitored for three years, and hold a meeting between Boeing’s board of directors and the families of people killed in two crashes. Lawyers for the families called it a “sweetheart plea deal,” and said victims’ families will object.

Get Big Business This Week in your inbox every week—and read it before everybody else! Sign up today.

Tweet of the Week

Open House, Closed House

Still want to buy a home? Fuggedabout it, says BofA. The housing market’s lock-in effect could last into the next decade as mortgage rates stay high even with Fed cuts, analysts at Bank of America wrote Monday: “The wide gap between current mortgage rates and effective mortgage rates means most homeowners are unwilling to move unless forced,” they wrote. “Moreover we do not expect current mortgage rates to fall much even if the Fed cuts as we anticipate.”

Here’s the problem: More than half of the mortgages currently in place on U.S. homes have an effective rate of 4% or lower, according to a recent report by the National Association of Realtors. But the current 30-year fixed-rate mortgage is still around 7%. That’s left homeowners unwilling to lose their great rates and start over at a higher rate for the next three decades.

The Increasing Cost of Independence

Got the urge to barbecue and watch fireworks this July 4th? You’re gonna pay for it! Hot dogs cost 7.3% more than last year, the biggest summer-cookout-staple increase, according to WalletHub. Chickens cost 1.5% more, beer 3.1%, and beef an average of 5.7%. Ice cream’s up only 1%, not bad considering overall inflation was up 3.3% in April from a year earlier.

Those hot dogs will make a big difference, though. Last July 4th, Americans spent an estimated $76 million on franks, and $4 billion on alcohol, including $700 million on wine. But that’s nothing compared to what was spent legally on fireworks last year: $2.7 billion, which caused a 42 percent decrease in air quality last Independence Day. (On average, WalletHub reported, 740 people wind up in the ER with fireworks-related injuries every July 4th.) And where do 96% of our fireworks come from? According to WalletHub: China.

In fact, the U.S. imported 203.7 million kilograms of fireworks last year, almost 99 percent of which, or 201.4 thousand metric tonnes, came from China. In all, the U.S. imported $803 million worth of fireworks in 2022, with Chinese bottle rockets, roman candles and other fireworks worth $786 million.

According to Staista, there’s one man behind the trans-Pacific fireworks trade, Ding Yan Zhong. Ding’s companies account for about 70 percent of the pyrotechnics entering the U.S., and on average 72 of his containers enter the country every single day. Surprisingly, Spain comes second in terms of fireworks imports, with 800 tons of pyrotechnics making their way across the Atlantic in 2022.

Interestingly, fireworks were almost subjected to tariffs by Trump import policies in 2019, but were exempted after one Ohio retailer donated $750,000 worth of fireworks to the White House.

Peter S. Green is a veteran reporter and editor who has spent more than two decades covering business and finance from Eastern Europe to New York City, and has worked for Bloomberg News, The New York Post, The New York Times and The Messenger. He lives in New York City and is always looking for the next big story.