Tulsi Gabbard (D-Hawaii) says the prospect of Facebook introducing a new, digital currency, Libra, would too greatly expand the company's access to personal data.

"Giving someone like Mark Zuckerberg the power of his own currency, and what he can do with the information, the personal information, that he's already gathering, I think it's very dangerous," Gabbard told Cheddar Tuesday.

Her comments followed an, at times, hostile hearing organized by the Senate Banking Committee over the tech giant's new venture.

The Congresswoman from Hawaii will have the opportunity to grill Facebook executive David Marcus on Wednesday, when he's expected to testify to the House Financial Services Committee, which the representative sits on, if she shows.

Last week, Marcus sent a memo to the committee's chairwoman Maxine Waters attempt to assuage officials' concerns over the currency. But representatives don't yet appear assuaged, and now some politicians are passing a draft of a "Keep Big Tech Out of Finance Act."

Ranking member of the Senate Banking Committee Sherrod Brown (D-Ohio), is equally concerned with Libra, and told Cheddar after the hearing that the new crypto division is a "scheme." Brown was one — if not — the most aggressive critic of Facebook at Tuesday's Senate hearing.

"They're an American company when it serves them, but they're not particularly American company when it comes to paying their taxes, and now doing this whole 'scheme' on cryptocurrency," Brown told Cheddar.

Gabbard said she believes it's Congress' responsibility to break up big tech companies, such as Facebook, over antitrust concerns. Other fellow presidential candidates like Sen. Elizabeth Warren (D-Mass.) have called for increased government regulation of large, technology platforms.

Although the regulation of big tech has not been the focal point of Gabbard's 2020 pitch, the growth of these tech giants may pose a free speech threat to American citizens, and could become a more significant issue in the 2020 Democratic presidential primaries

"These monopolies, which is exactly what they are, should not have unilateral power that they have right now, to control what kinds of information we are seeing, and to shut up certain voices in this country," Gabbard added, pointed out the antitrust concerns she has with Facebook, and tech giants.

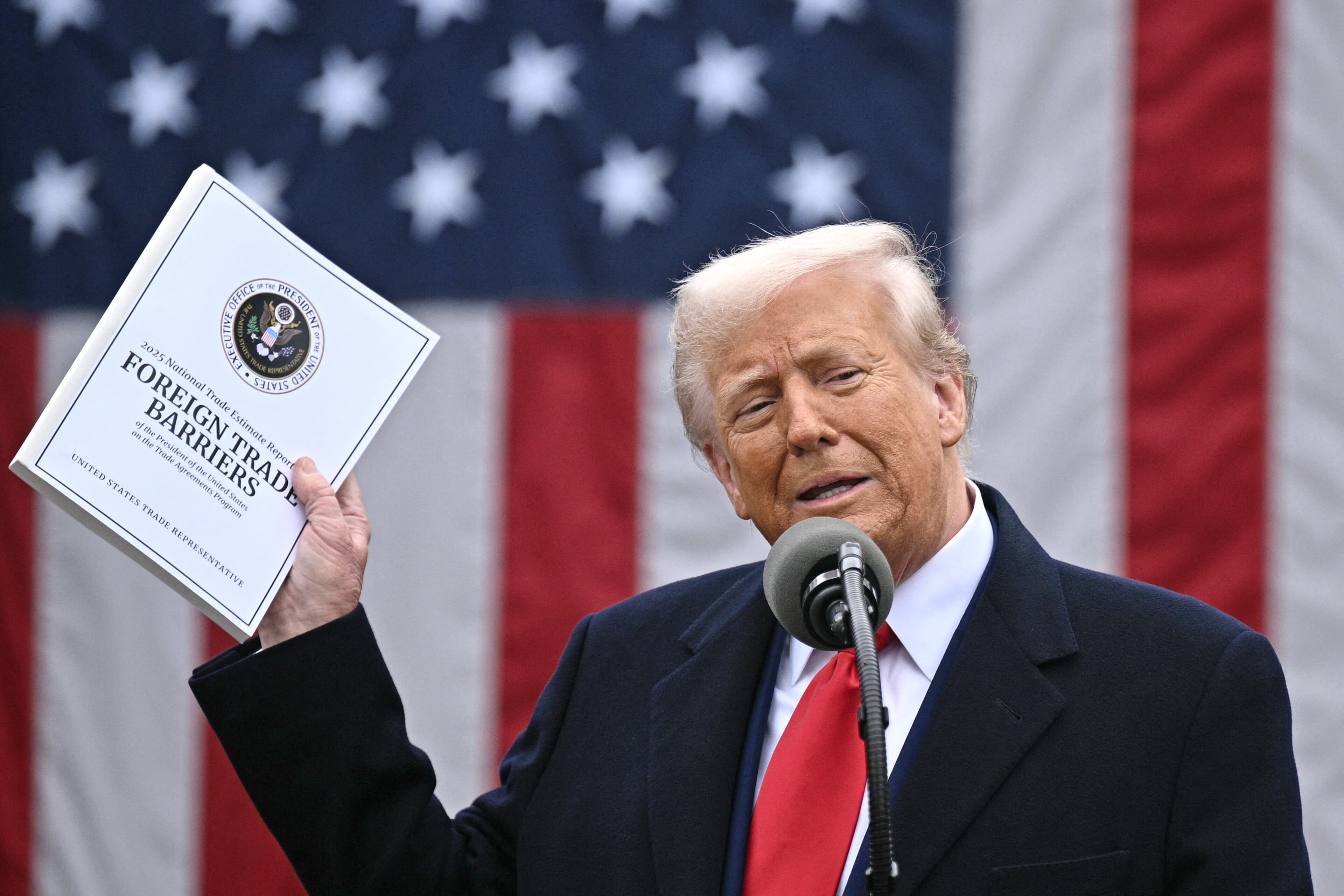

Even Donald Trump has taken a stab at Libra, as bipartisan support grows in the dismantling of tech giants. He wrote, "Facebook Libra's 'virtual currency' will have little standing or dependability. If Facebook and other companies want to become a bank, they must seek a new Banking Charter and become subject to all Banking Regulations, just like other Banks, both National and International."

Although Democrats and Republicans may disagree on their overall concerns over Libra, and the growth of big tech as a whole, Gabbard remains cautious of leaders like Mark Zuckerberg:

"I think it's a very dangerous thing to give that much power and influence and money in the hands of one person."