Most of Generation Z isn't even old enough to buy cannabis, but those that are have proven themselves a small but mighty consumer group. In the first half of 2021, Gen Z overtook Baby Boomers, clocking more overall cannabis sales across four legal states for the first time ever, according to data from analytics company Headset.

"If this trend continues in, you know, [in] 10 to 15 years when this cannabis-native age group is more … of legal age in a more large scale, they're definitely going to be the largest generation in terms of total sales. There's no question about that," Headset senior analyst Cooper Ashley said.

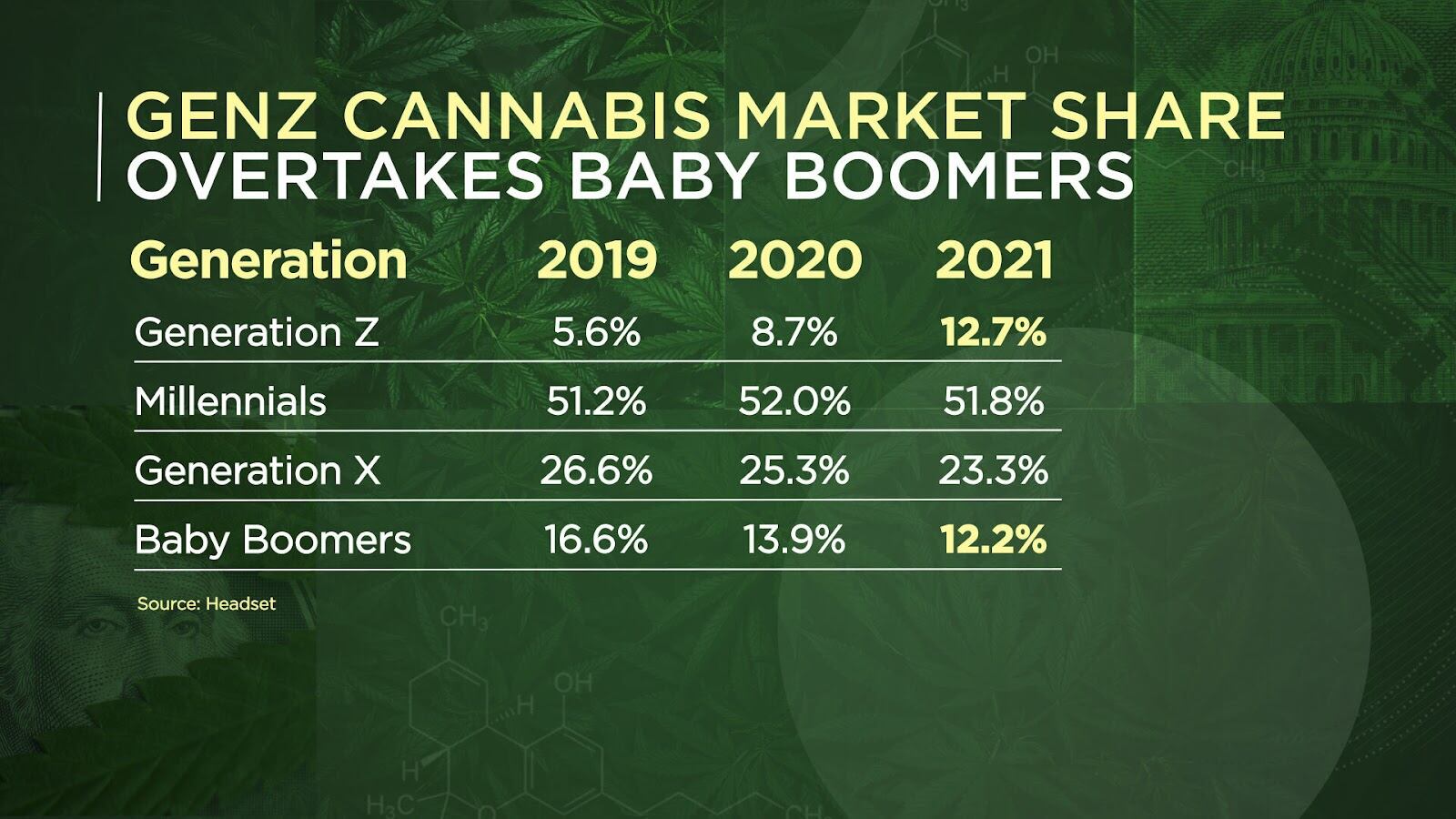

Only a small fraction of Generation Z, who are roughly aged 9- to 24-years-old, are eligible to purchase cannabis legally. Even so, Gen Z accounted for about 12.7 percent of cannabis sales — up 4 percent year-over-year — in California, Colorado, Nevada, and Washington during the first half of 2021. Baby boomers accounted for just 12.2 percent of sales in that same period, down from 13.9 percent in the year-ago period. That means that for the first time ever, GenZ beat out Baby Boomers in terms of total cannabis sales. Even millennials, the undisputed leaders in cannabis consumption, lost market share to Gen Z, accounting for 51.8 percent of sales in 2021, down 0.2 percent year-over-year.

Overall sales among Generation Z also skyrocketed 127 percent from $376 million in 2019 to $855 million in 2020. Proportionally, that's almost three times as fast as millennials, which saw sales grow by some 46 percent from nearly $3 billion in 2019 to more than $4.3 billion in 2020. Ashley attributed much of GenZ's exponential growth to the simple fact that not all are eligible to buy cannabis. As more young adults in Generation Z turn 21, those sales will continue to spike.

"Basically every single day, there are more and more and more Gen Z customers turning 21 and therefore being of legal age to purchase cannabis. And as far as we can tell, they're going to become one of the most important, if not the most important, demographic groups in the cannabis industry," Ashley said.

Growth of sales by age group also tends to drop off with the older generations, according to a report from Headset. Gen X sales grew by 29 percent from $1.6 billion in 2019 to $2 billion in 2020, and Baby Boomers sales grew by just 5 percent year-over-year from $974 million to just over a billion dollars. The Silent Generation, aged 75- to 95-years-old, was the only group that saw sales decline in that period by about 18 percent from $50 million to $41 million.

A drop-off in sales among older adults could have any number of causes, particularly amid the COVID-19 pandemic when consumers were encouraged to stay home to avoid viral exposure. But the report also suggests that cannabis may be a more intrinsic part of life for Generation Z, versus older adults who may view cannabis as more of a splurge or novelty.

Even as sales of cannabis among Generation Z tick up, younger individuals are reporting less interest in alcohol. A frequently cited 2018 report from Berenberg Research surveyed Gen Zers about drinking habits and preferences. Respondents in their teens and early 20s reported drinking about 20 percent less per capita than millennials did at the same age, according to Business Insider. Furthermore, some 64 percent said they expected to drink less frequently than older generations as they age.

The same trends were also true of millennials and Gen X before them, indicating younger generations consistently report drinking less than older generations. But Generation Z does have some unique qualities that could impact their consumption habits. For one thing, even those in Generation Z who are currently eligible to buy cannabis were born after California legalized medical cannabis in 1996. Alaska, Oregon, and Washington followed suit soon after in 1998. Today, some 36 states have legalized medical cannabis and 18 and counting have also legalized recreational use.

"People talk about … digital natives being born after the iPhone was invented or growing up with high-speed internet or all those things. I think the same could be said for the majority of Gen Z. They are growing up in a world where cannabis is normal," Ashley said. "The taboo is disappearing from their lives much earlier than it is from anybody else's, so I would expect Gen Z to see cannabis more equal to alcohol as just another choice of intoxicating substance."

Gen Z has also been a crucial bastion of support, alongside millennials, for the sober curious trend, which the Washington Post described as less of a fad than a "burgeoning wellness movement." CBD, a non-psychoactive compound of cannabis, was embraced as a wellness product after the 2018 Farm Bill effectively legalized it. Cannabis industry executives have also worked to shoehorn THC and cannabis into the broad wellness category, too, boasting products that provide a similar social lubricant effect as alcohol but with, they say, fewer side effects.

It may be too soon yet to draw conclusions about how or what Generation Z prefers to consume, but if early sales growth trends are any indicator, this "cannabis native" generation will be a valuable consumer segment for the industry moving forward.