2020 was undoubtedly a year of ups and downs, with the economy seeing sky-high records along with devastating lows. And for major tech players in the mergers and acquisitions market, this year's activity resembled a valley between two peaks.

Before COVID-19 hit, there was extensive consolidation throughout the tech industry already unfolding. February saw more deals valued at over $1 billion than any other month in 2020, led by Morgan Stanley with its $13 billion acquisition of online brokerage E-Trade.

But a pandemic-stricken spring and summer that rattled markets and sent valuations swinging unpredictably put M&A activity on the back burner. Then came September.

Of the 19 tech deals valued above $1 billion, more than half were announced in the last four months of 2020. And chipmakers Nvidia and Advanced Micro Devices made serious waves.

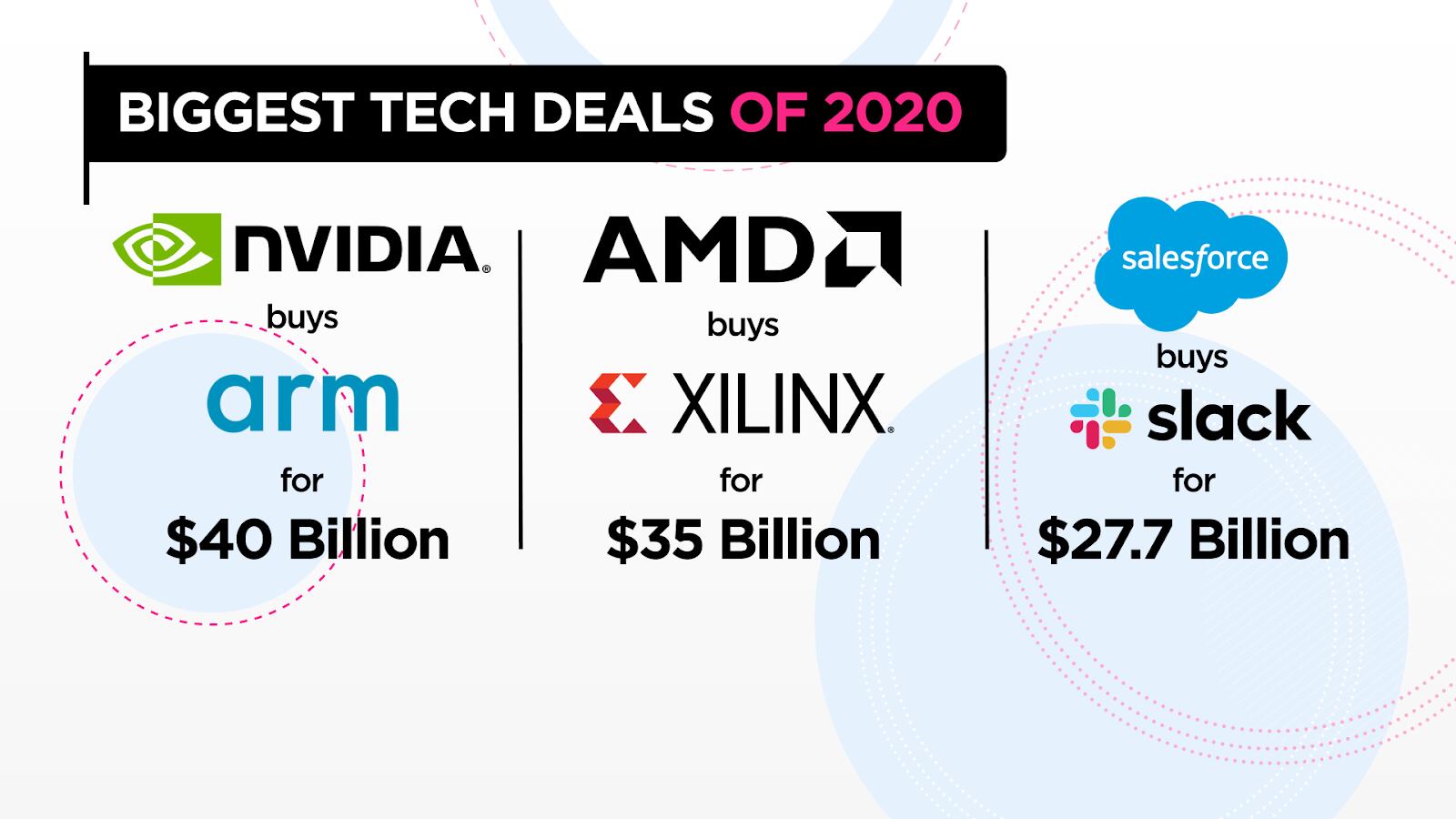

U.S.-based Nvidia ($NVDA) took home the “biggest deal of the year” honors with a $40 billion acquisition of British chip designer Arm, purchasing the company from Japan’s SoftBank.

Because Arm has some operations in China, rival chipmakers like Huawei are urging Beijing regulators to block the transaction. Both companies expect the massive deal to take a whopping 18 months to complete. Arm’s CEO Simon Segars recently said that he expects regulators to “take a good look” at his company’s deal with Nvidia.

Just a month later, rival semiconductor manufacturer Advanced Micro Devices ($AMD) announced it’s acquiring Xilinx ($XLNX), the world’s leading provider of adaptive computing solutions, for $35 billion to expand its portfolio and bring AMD’s total assets under management to $110 billion.

It’s no surprise that chipmakers went on a buying spree this year as more people locked indoors meant more video games being played, driving demand for state-of-the-art graphics cards. AMD’s chips are powering the new Xbox Series X/S and PlayStation 5 gaming consoles.

But Nvidia, which also completed a $6.9 billion deal to acquire Mellanox as a way to elevate customers’ computing power, isn’t the only company that scooped up multiple billion-dollar companies this year.

In February, Salesforce ($CRM) bought mobile software company Vlocity for $1.3 billion to expand its cloud computing business and capped off the year with the eye-catching deal to purchase Slack for $27.7 billion.

Cheddar anchor Kristen Scholer picked the third biggest acquisition of the year as her favorite deal to shake out on Wall Street.

Kristen Scholer's Top M&A Pick:

2020 was also the year that Uber appeared to throw in the towel on self-driving technology, selling its autonomous driving unit Advanced Technologies Group to Aurora for $4 billion. It was Cheddar anchor Nora Ali’s favorite acquisition of the year.

Nora Ali's Top M&A Pick:

While the pandemic proved disruptive to the M&A landscape, well-capitalized companies seized the opportunity to diversify their portfolios and grow their businesses.