Credit card debt in America has reached $905 billion dollars, according to a recent NerdWallet survey. Kimberly Palmer, Personal Finance Expert at the company, joins Cheddar to explore some of the reasons behind the increase.

Two categories have outpaced income growth over the past decade: medical expenses and food. Healthcare costs, in fact, have increased by 34% while income has only grown by 20%. She gives some alternatives for how to pay off those expenses without whipping out the credit card.

Plus, people always say you're throwing out money when you rent a home, but how much money are homeowners throwing away in credit card interest? Palmer says that a house may be a great asset, but owners tend to ring up double the amount of credit card interest versus renters when spending on things like upkeep.

Peacock is seeing big success from its original series, 'Twisted Metal.'

Janice Lieberman of Consumer Reports discusses how to maintain your car to save money down the road.

Airlines will continue to operate fewer flights to New York and Washington to cut down on cancellations and delays.

A new report found that business travel is becoming more expensive.

X Corp. CEO Linda Yaccarino told CNBC that she has "autonomy" under Elon Musk, adding that she wants advertisers to be comfortable to return.

Verizon Wireless said it plans to raise the prices of some of its plans.

Food service workers in Las Vegas are set to take to the Strip Thursday as they demand higher pay and better benefits.

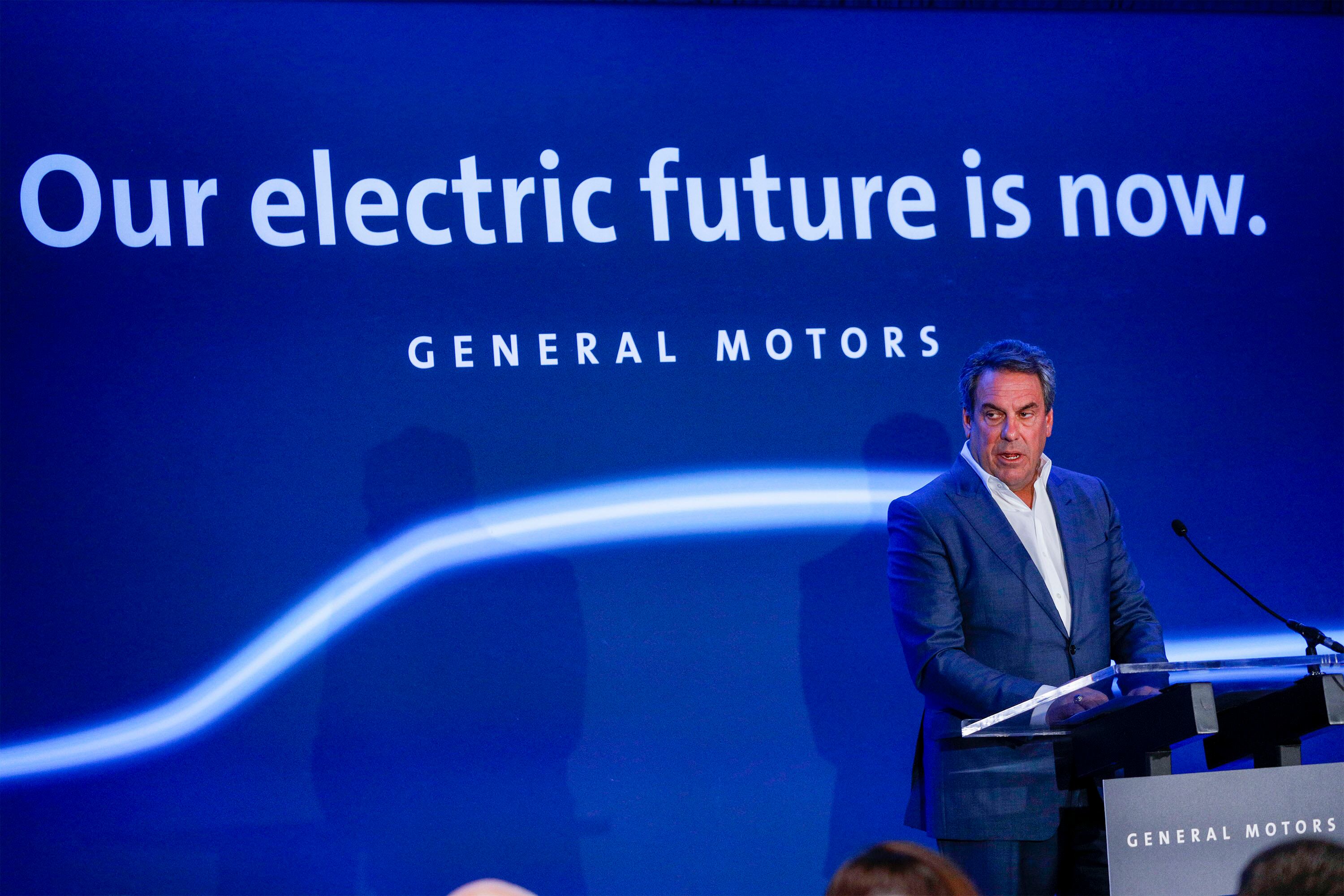

GM President Mark Reuss joined Cheddar News to discuss the company's new Cadillac Escalade electric vehicle and talked about how to make affordable EVs for the general public. "That's who we are as a company -- we will offer vehicles for everybody and every different income level," he said.

Lauren Fix, automotive expert with 'The Car Coach,' spoke with Cheddar News to provide tips and advantages on buying a used vehicle. "You let somebody else take the depreciation, which is probably one of the best things ... you then move in at a two- or three-year-old vehicle that maybe was leased, and you can get some great values," she said.

Disney said it's increasing prices for its ad-free streaming services as the company is losing subscribers and also announced it planned to crack down on password-sharing. Cheddar News' Michelle Castillo broke down Disney's moves.