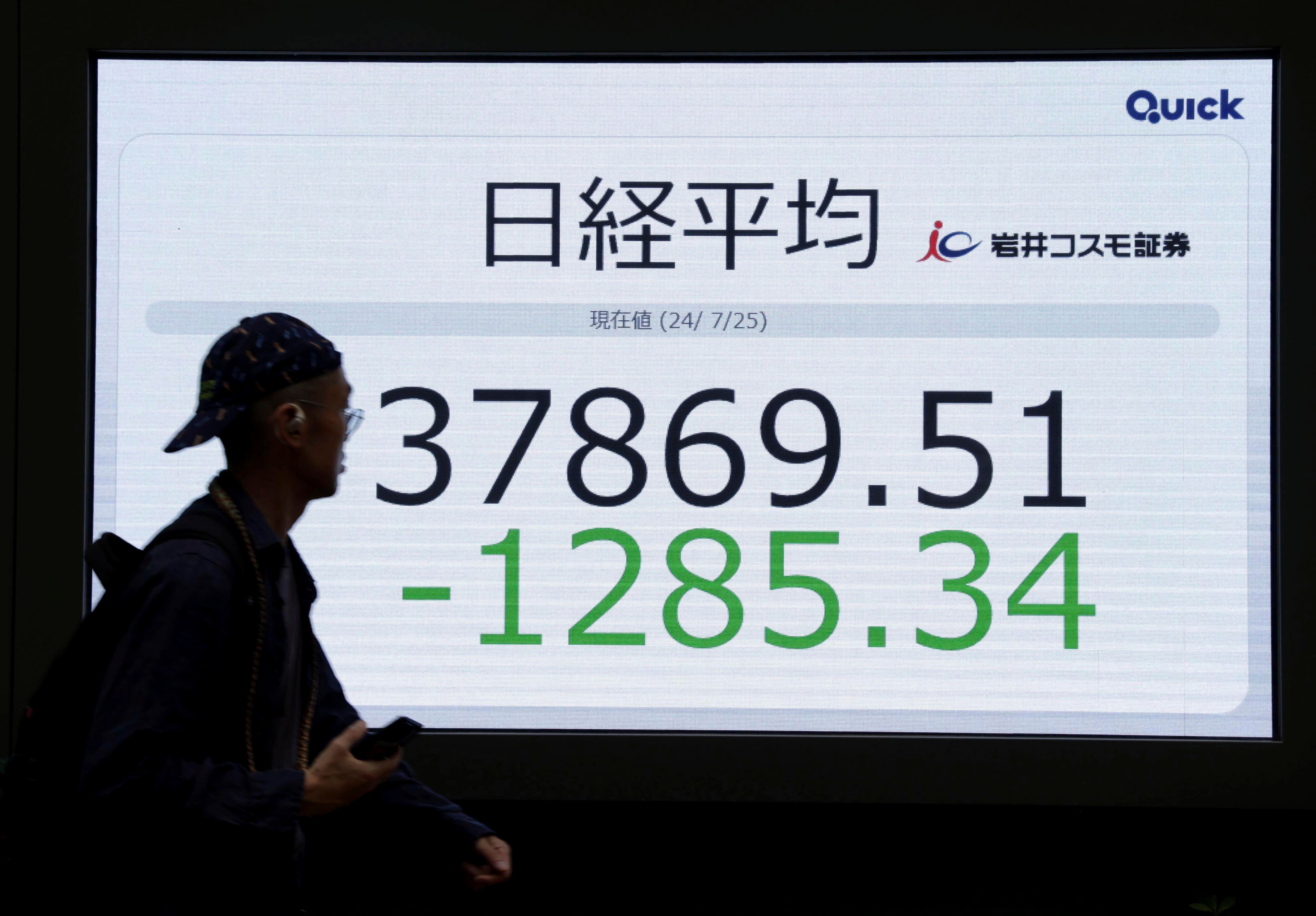

TOKYO (AP) — Global shares retreated on Thursday, with Tokyo’s benchmark losing more than 1,300 points at one point and closing down more than 3%, as pessimism set in over a nose-dive on Wall Street.

France's CAC 40 slipped 1.5% in early trading to 7,400.08. Germany's DAX fell 1.2% to 18,161.70, while Britain's FTSE 100 shed 1.1% to 8,066.27.

The future for the S&P 500 fell 0.2% while that for the Dow Jones Industrial Average rose 0.2%.

U.S. stock indexes suffered their worst losses since 2022 after profit reports from Tesla and Alphabet helped suck momentum from Wall Street’s frenzy around artificial-intelligence technology.

In Asia, Japan's benchmark Nikkei 225 lost 3.3% to 37,869.51, its lowest close since April.

The recently strengthening yen, which has recovered from trading above 160 Japanese yen to the dollar earlier this month, hurts profits of Japanese exporters when they are brought back to Japan. Toyota Motor Corp. shares dropped 2.6%, while Sony Group's sank 5.4%.

In currency trading, the U.S. dollar edged down to 152.50 yen from 153.89 yen. The euro cost $1.0844, up from $1.0841.

The yen has been gaining against the dollar largely because of speculation the Bank of Japan will raise its near-zero benchmark interest rate soon. The central bank's next policy meeting ends on July 31.

“The major risk is that the BOJ might refuse to hike next week, causing the entire long yen trade to collapse. But that’s probably just a bad thought,” said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

Chinese shares fell as investors questioned a central bank decision to cut another key interest rate after several similar moves earlier this week.

Hong Kong’s Hang Seng declined 1.7% to 17,021.91, while the Shanghai Composite fell 0.5% to 2,886.74.

South Korea’s Kospi declined 1.7% to 2,710.65 after the government reported the economy contracted at a 0.2% rate in the last quarter.

Among the region’s technology shares, Samsung Electronics fell nearly 2%, while Nintendo lost 2.4%. Tokyo Electron tumbled nearly 5%.

Australia’s S&P/ASX 200 shed 1.3% to 7,861.20.

Wednesday on Wall Street, the S&P 500 tumbled 2.3% for its fifth drop in the last six days, closing at 5,427.13. The Dow Jones Industrial Average dropped 1.2% to 39,853.87, and the Nasdaq composite skidded 3.6% to 17,342.41.

Profit expectations are high for U.S. companies broadly, but particularly so for the small group of stocks known as the “ Magnificent Seven.” Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla need to keep delivering powerful growth after being responsible for most of the S&P 500’s run to records this year.

Tesla was one of the heaviest weights on the market and tumbled 12.3% after reporting a 45% drop in profit for the spring, and its earnings fell short of analysts’ forecasts.

Tesla has become one of Wall Street’s most valuable companies not just because of its electric vehicles but also because of its AI initiatives, such as a robotaxi. That’s a tough business to assign a value to, according to UBS analysts led by Joseph Spak, and the “challenge is that the time frame, and probability of success is not clear.”

In energy trading, benchmark U.S. crude lost 59 cents to $77.00 a barrel. Brent crude, the international standard, fell 56 cents to $81.26 a barrel.