That federal emergency stimulus check could be delivered to Americans through a new digital wallet maintained by your friendly neighborhood Federal Reserve member bank.

As part of a counterproposal to the $2 trillion stimulus bill proposed by Republicans, blocked for the second time Monday, House Democrats have proposed that the Fed make payments to people in “digital dollars” through “digital dollar wallets” which could be opened at various financial institutions. The hope is that it would ensure that everyone eligible receives a check, whether or not they have a bank account, and that they get it quickly.

A separate proposal by the House Financial Services Committee includes the same idea. Both proposals, dated March 22, describe digital dollars as electronic units of value expressed in dollars that can be redeemed at an eligible financial institution (a member bank of the Board of Governors of the Federal Reserve System). The same banks could also maintain “pass-through digital dollar wallets,” which would allow recipients “a pro rata share of a pooled reserve balance” held by the bank.

If passed, banks would have to make the wallets available to U.S. citizens, legal permanent residents and business entities by January 1, 2021. If there isn’t “sufficient information to make direct deposit payments” to the individual, they would be paid by check.

It’s unclear how likely it is that this proposal will see the light of day in a Republican-controlled Senate; although in Facebook’s Libra hearings on Capitol Hill last year Republicans showed they’re generally more open to digital currency ideas than Democrats (who understandably couldn’t get past Facebook’s then-leadership in the project, many Republicans felt the same way).

Michigan Democratic Congresswoman Rashida Tlaib also proposed a digital payout in her Automatic BOOST to Communities Act over the weekend. Tlaib is proposing every person in America receive a pre-loaded debit card that can be automatically re-upped each month “until one year after the end of the Coronavirus crisis.” In the long term, under the draft bill, debit and credit card infrastructure would eventually be converted into "a permanent, Treasury administered digital public currency wallet system.”

Central bank digital currencies have been a hot topic among central banks since the introduction of the Facebook-led digital currency project Libra last summer, which "really lit a fire” under the development of a digital dollar, Fed Chair Jerome Powell said Feb. 20 in a House Financial Services Committee meeting. Libra was, to many lawmakers, a threat to the U.S. dollar and sovereign currencies globally; it also gave China the impetus to create and deploy its digital yuan, which signaled the very beginning of a global digital money war against the dollar at the end of last year.

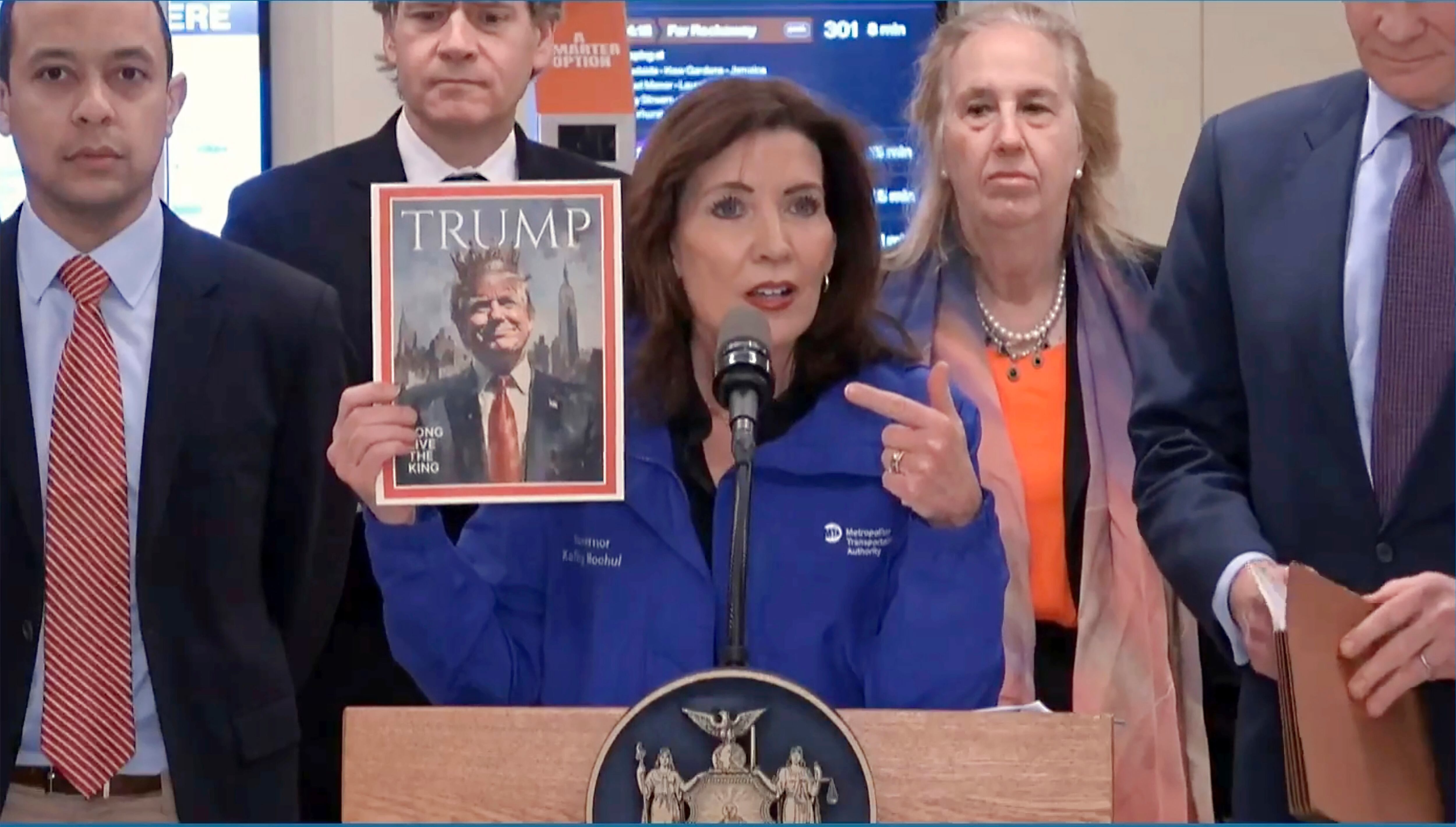

Powell did, however, take a wait-and-see attitude as to whether the Fed would actually ever issue a digital dollar at that meeting (which was before coronavirus). Former Commodity Futures Trading Commission J. Christopher Giancarlo and economist Judy Shelton, Trump’s nominee for the Federal Reserve Board of Governors, have both recently said the dollar could lose its global dominance if the U.S. doesn’t digitize it.