Today the Bureau of Labor Statistics released the much anticipated March Consumer Price Index and brought with it a treasure trove of data to be dissected by analysts, investors and consumers alike. With more people than ever heading to polls around the world and wars raging across Ukraine and the Middle East, let’s look at how inflation could affect the future of the US and global economy in this critical year.

Yearly inflation rose to 3.5 percent in March, slightly higher than expectations of 3.4 percent and much higher than the 3.2 percent recorded in February. It’s also the second consecutive increase and the highest annual increase in the past six months.

The report from the US Bureau of Labor Statistics showed that core inflation, which excludes changes in food and energy prices, remained at 3.8 percent. The same as in February but still higher than the 3.7 percent expected.

The prices of fuel and gas fell by 3.7 percent and 3.2 percent respectively compared to March 2023. Unfortunately, the prices of electricity, rent and transportation rose by 5 percent, 5.7 percent and 10.7 percent respectively.

The increase will likely mean the Federal Reserve keeps interest rates at their current levels of 5.25–5.5 percent (their highest since 2001) for a few more months yet. At the start of the year, analysts expected six quarter-point rate cuts but now believe there will only be two. The first of which will now come in September. Global stock markets fell on the news while treasury yields spiked, with the 10-year treasury yield moving back above 4.5 percent.

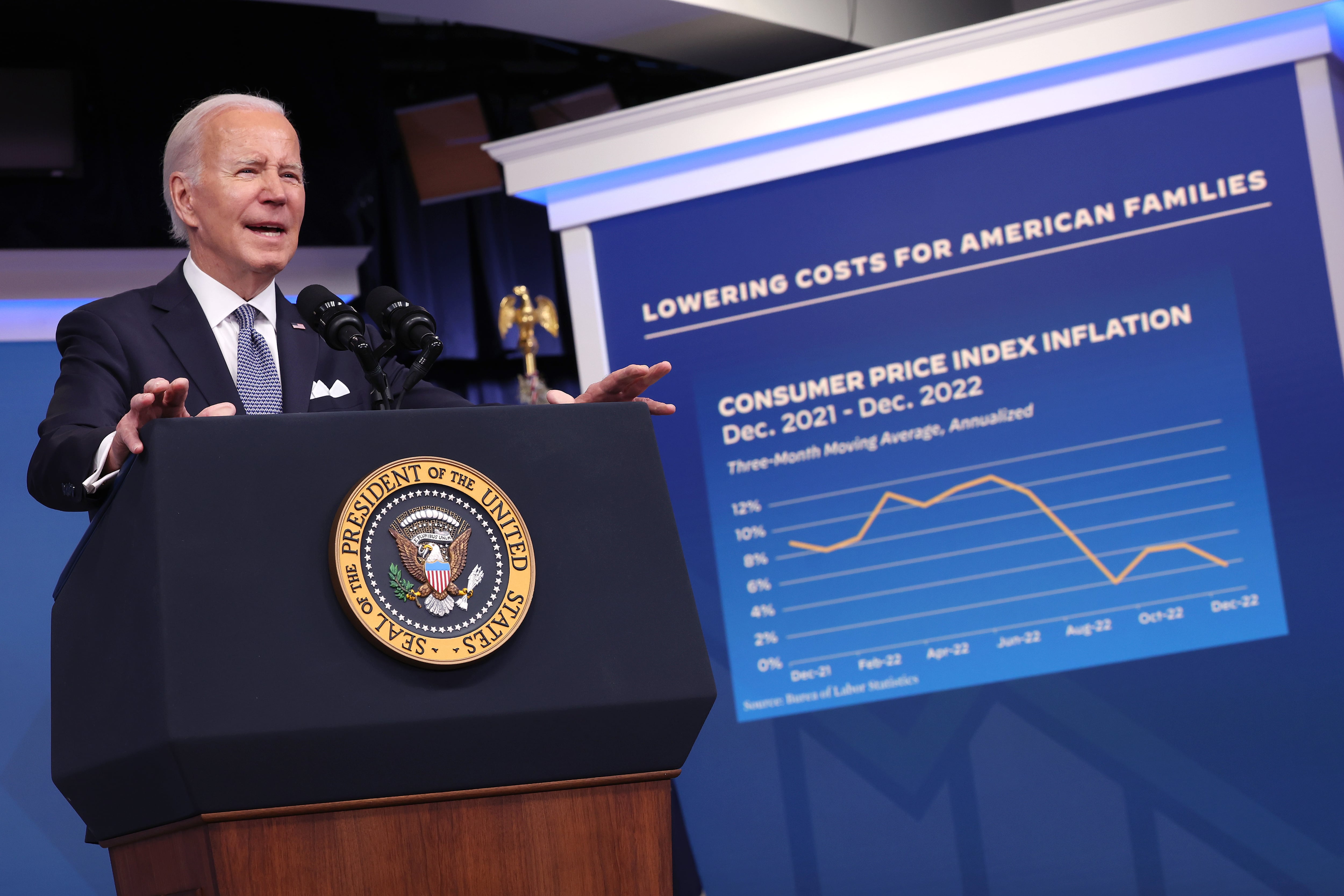

The stubborn inflation will do little to help the consumer who has had a tough time since the pandemic ended. Although it’s now far lower than its peak of 9.1 percent in June 2022, inflation remains higher than the 0–2.5 percent it was at between 2012–2020. The boom in inflation has meant the cost of living has spiked while wages have fallen — with more people being laid off, especially in the tech sector.

Nor will rising inflation help the Biden administration. It’s widely agreed that along with immigration, inflation will be the other major influencing factor in the November election. Biden’s handling of the economy has been one of the biggest issues with voters during his time as president.

“Today’s report shows inflation has fallen more than 60% from its peak, but we have more to do to lower costs for hardworking families. Prices are still too high for housing and groceries, even as prices for key household items like milk and eggs are lower than a year ago,” Biden said in a statement Wednesday.

The report will also cast major doubts on whether inflation really is on track back to the Fed’s 2 percent target as many believed it was in the second half of last year. Chair of the Federal Reserve Jerome Powell said in March of this year that he wants to see more evidence that inflation is falling before cutting interest rates. This report certainly won’t do anything to raise his hopes.