Thinking about buying a home but not sure where to start? You may want to think about applying for a mortgage. Maggie Leigh Marshall, Licensed Associate Real Estate Broker, joins Your Future Home to discuss what paperwork is needed to get a mortgage and how to present the best offer possible.

There is a very big difference between being pre-approved and pre-qualified for a mortgage. Marshall talks through what each step means and explains why it's so important to make sure you are pre-approved before jumping into the housing market.

Plus, what do sellers want to see in an offer? Marshall says you need to provide proof-of-funds and a good debt/income ratio. For a reference, she believes your debt shouldn't exceed your income more than 30%. However, the lower the number is the better chance you have to be approved for the house.

Women outnumber men in the largest urban counties east of the Mississippi River, along the Eastern Seaboard and in the Deep South, while the West skews male, according to data released last week from the 2022 American Community Survey 5-year estimates.

A giant panda at the Beijing Zoo had a lot of fun playing in the snow this week.

A favorite animal at the St. Louis Zoo in Missouri is moving to Columbus, Ohio.

Cheddar News staff pulled some of their ugly sweaters out of their closets to celebrate National Ugly Christmas Sweater Day.

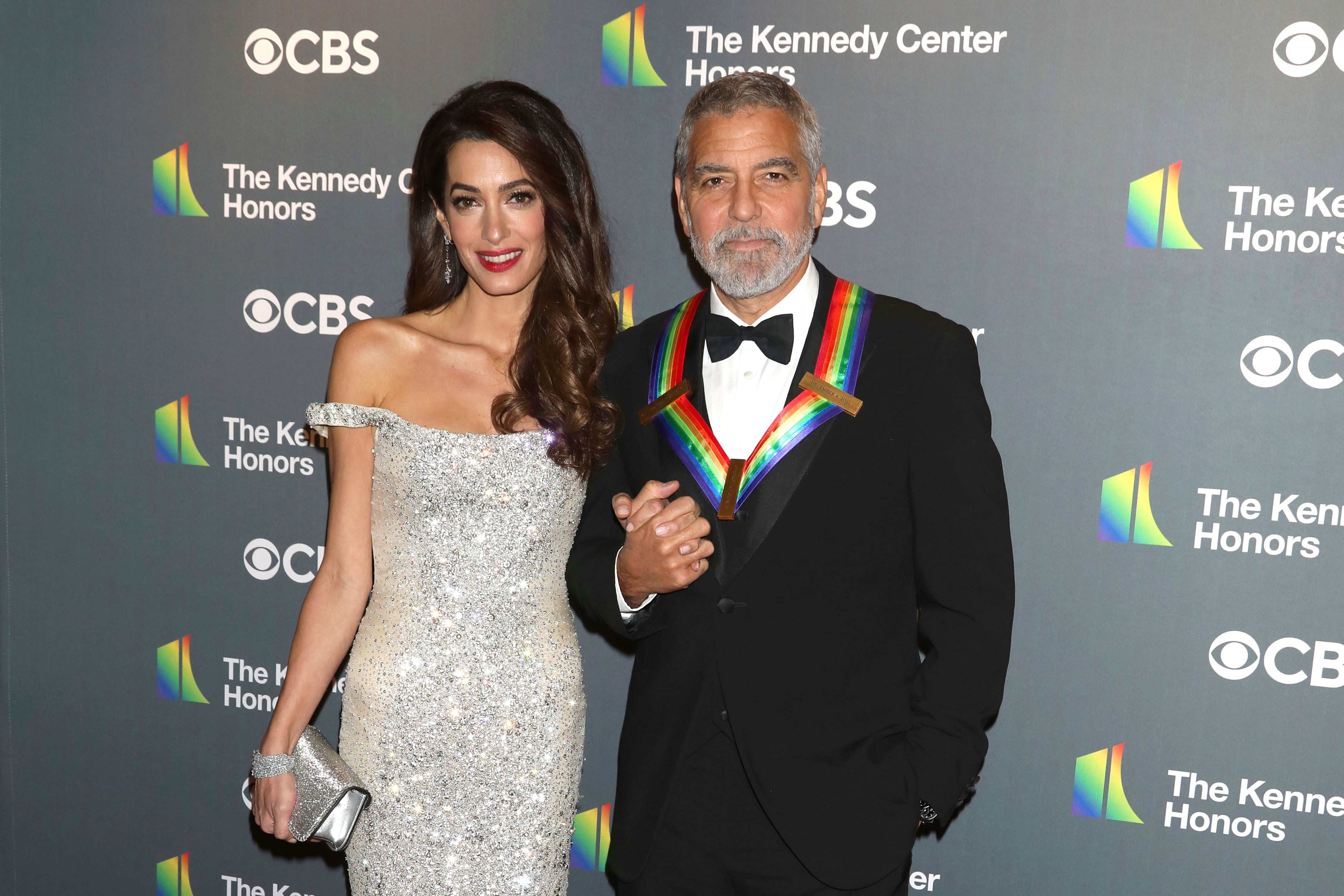

George Clooney and Adam Sandler are teaming up to star in a new feature film for Netflix.

A new study found daydreaming could have big benefits.

A new study published in the journal Genome Biology and Evolution is shedding light on why some people are morning folks.

With holiday shopping underway, people have to be aware of authentication when purchasing quality luxury gifts. Maya Ali, head of handbags at MyGemma, joined Cheddar News to provide tips on how to spot fake luxury bags.

You've never heard harmonica like this! Check out this group that gets together to jam out, picking out songs you don't typically think of when you think of the pocket instrument.

Wondering what to watch this weekend? This week we have a rebel cyclist, a rebel who built his own island, and some rebel children who entered a magical wardrobe.