With its mobile-friendly format and high-quality content, Quibi was supposed to usher in a new era of short-form entertainment for audiences on the go. Led by Disney and Dreamworks Animation executive alum Jeffrey Katzenberg and former HP CEO Meg Whitman, the business had the media and technology star power to stand out from other startups. It also boasted Hollywood's hottest names, like Liam Hemsworth, Sophie Turner, Chrissy Teigen, and Jennifer Lopez, headlining its bite-sized shows and movies.

But recent data shows the service isn't gaining as much traction with viewers as one might expect, especially with the initial subscribers' three-month free trial period wrapping up in a few weeks.

"Fundamentally, the concept is very hard for consumers to really understand what they are getting," said Jim Nail, principal analyst for marketing research firm Forrester. "It's supposed to be high-quality content with these names like Jeffrey Katzenberg, but it's not a TV show or a movie. And I still have to pay for it and get advertising."

Quibi, which launched on April 6, ranks number 272 among free iPhone apps in the U.S. App Store, according to Sensor Tower. At its worst, it dropped to 1,477th place on June 4, when it paused advertising during the Black Lives Matter protests. Sensor Tower estimates Quibi has been downloaded 4 million times since it launched, though the company disputed the figures to the Los Angeles Times, saying its internal data accounts for about 4.6 million downloads.

A recent report from The Wall Street Journal said Quibi is projecting fewer than 2 million subscribers in its first year, according to an unnamed source, a far cry from the 7.4 million the company was predicting initially. The company, which has raised $1.75 billion to date, may need to raise another $200 million by the end of 2021. Quibi did not respond to Cheddar's request for comment. Part of its slow start could be pegged to the coronavirus shutdowns. When Quibi launched in April, by which point widespread shutdowns were in effect, there were questions about whether an audience who didn't need to be on the go would be interested in a mobile-only service."The pandemic is probably a contributing factor," Nail explained. "The concept is supposed to be filling in those little gaps in your day when you have those three, five-to-eight minutes to do nothing else. We're just not in those situations of commuting."

However, LightShed Partners partner Rich Greenfield points out other short-form platforms like TikTok have found success during the coronavirus crisis, meaning it's unlikely Quibi's woes can be fully blamed on the pandemic.

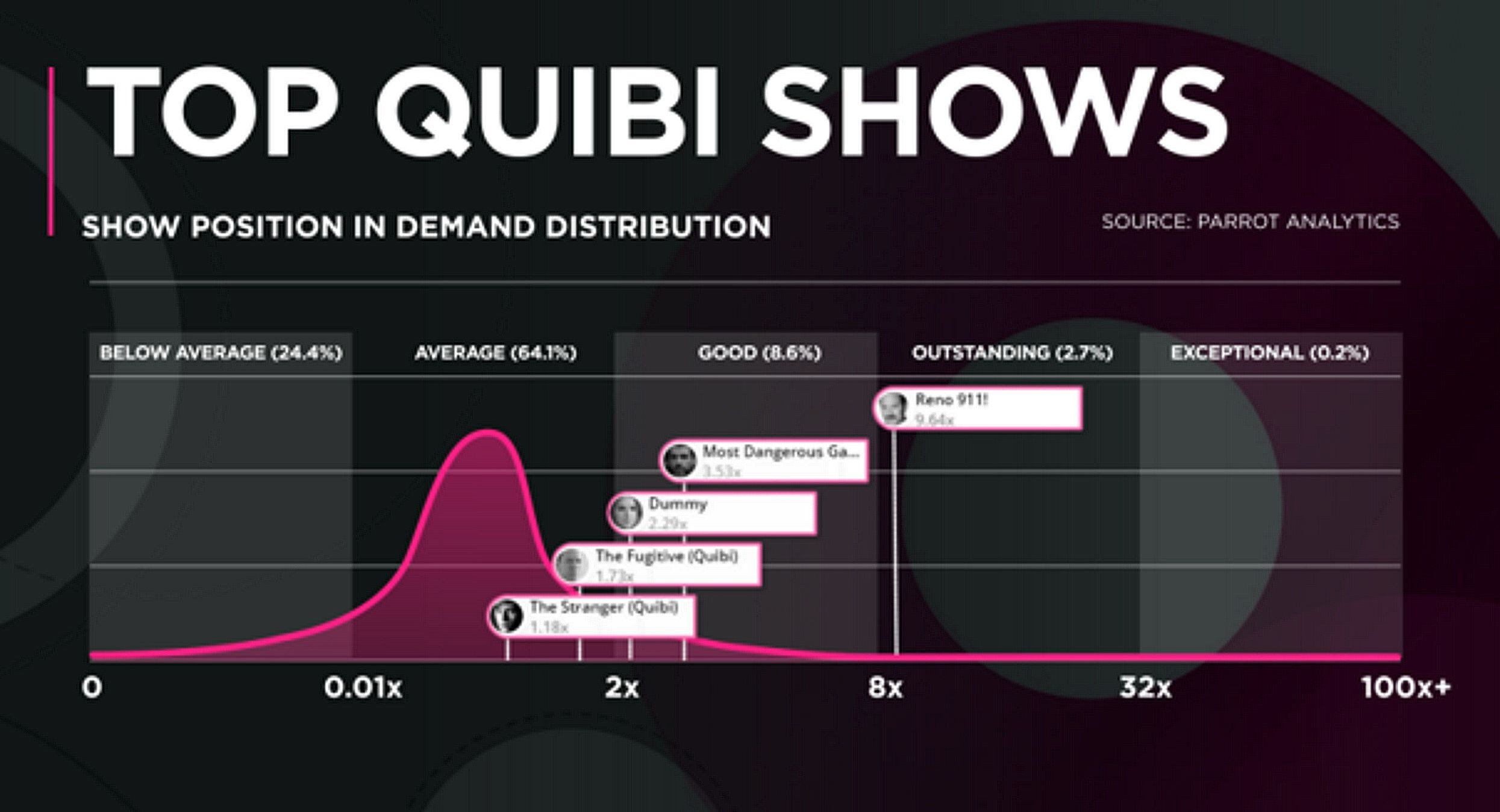

"They haven't figured out how to explain the service to consumers – and they haven't found a piece of content that is so [worth watching] that it compels signups," Greenfield said. Data from Parrot Analytics shows that Quibi's most popular show currently is its reimagined version of Reno 911!, which is at 9.64 times the market demand above the average TV show. The Most Dangerous Game is 3.53 times high and Dummy and The Fugitive are both at about double typical demand. But the rest of its shows hover at the same demand, or less than, the typical program. The figures pale in comparison to Disney+'s The Mandalorian, which reached 55 times average demand and put the service on the map.

Nail suggests Quibi, which was built to be a brand-safe vehicle for advertisers, re-think its strategy. "Let them create long-form content and try to create a niche streaming service that has unique content that is compelling enough that you can get people to come to it and put up with the advertising," Nail said. "Or maybe forget trying to distribute it yourself and license to Netflix, Hulu, and Amazon because that's what Katzenberg knows what to do."

Quibi does have some promising shows including 60 Minutes in 6, a shorter version of the flagship CBS show, Greenberg added. But until it has a hit, it could continue to flounder.

"If the content is compelling enough, consumers will come," he said.