While stock trading app Robinhood’s users may be hesitant to trust the platform again after a series of recent outages, these investors seem to be putting their faith in the federal government amid this market downturn.

Robintrack, a service that keeps counts of how many Robinhood users own a particular stock, shows that its userbase has been loading up on stocks harshly affected by the outbreak.

Behind Ford, which gained about 125,000 Robinhood shareholders over the past month, American Airlines and Delta Airlines stock cracked the top four most popular stocks during that time. The companies are owned by a combined 170,000 Robinhood users that didn't own them a month ago.

The airline industry stands to benefit significantly from the coronavirus stimulus package that passed the Senate Wednesday and the U.S. House on Friday, with $50 billion in grants and loans allocated to help keep passenger airline companies afloat.

As for another company up in the air, Robinhood users jumped at the chance to purchase Boeing stock at a rare price of under $100 dollar a share. It was the eighth most popular new stock purchased over the past month.

As seen below, while stock prices for these companies began to fall, investor interest quickly filled the void.

Earlier Friday, Treasury Secretary Steve Mnuchin told Fox Business that there is no plan for Boeing to receive money from the federal government. Initially, there had been reports that Boeing had requested at least $60 billion in government aid. The Dow’s largest component fell more than 10 percent to end the week.

Cruise lines Carnival and Norwegian were the seventh and 10th most popular Robinhood stocks over the past month, respectively.

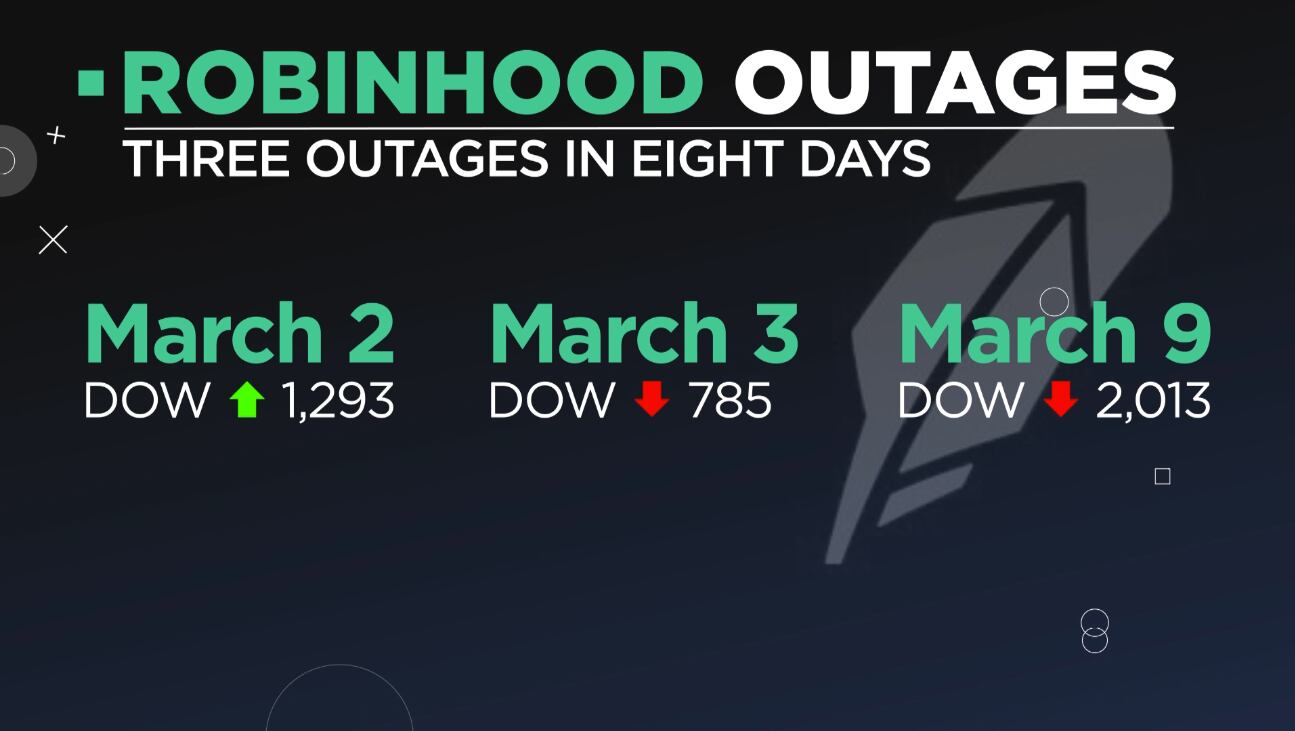

At last count Robinhood had more than 10 million accounts, but now the platform is tasked with re-establishing trust with its userbase. Three outages in March shook customer confidence in the service, as investors were forced to the sidelines on historic trading days.

Robinhood is now offering credit to some of those customers and says it fixed the engineering issues that led to the outages.

“An apology alone won't rebuild your trust in us,” the startup said in an email to some customers. “Instead, we hope our actions will."