Responsible for the most impressive IPO of 2020 so far, mobile-based insurance startup Lemonade will start offering customers coverage for their pets.

Tim Bixby, the chief financial officer at Lemonade, told Cheddar Friday that the company is focused on eventually providing its customers with a full suite of products.

"We're working our way through the total portfolio of what the customer is gonna want from us over time," Bixby said, adding that homeowner's insurance, as well as condo and renter's insurance, has been the primary focus to date.

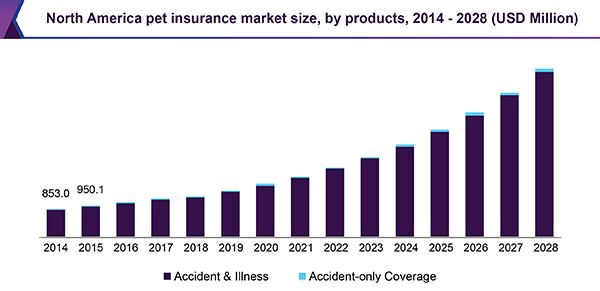

Why is pet insurance the next step for Lemonade? According to Grand View Research, the pet insurance market in North America is expected to climb from its current estimated value of $4.4 billion to $14.9 billion by 2028.

"Pet insurance has been dealt with in a fairly mechanical way," Bixby said. "We came at it with a different approach. It turns out pets are not really possessions. They're members of the family, and so we built the product with that in mind."

Rather than targeting corporate clients that want to offer pet insurance as an employment perk, Lemonade wants to focus on existing customers.

On July 2, Lemonade made major waves on Wall Street with a stellar public debut. Despite pricing the IPO at $29 a share, $LMND soared as high as 144 percent to finish its first day of trading just shy of $70 a share.

Lemonade raised $319 million in its IPO, capital that will be used to acquire new customers.

"The lifetime value of an insurance customer, we believe, is significant," Bixby said. "Most of our customers are first-time insurance buyers in many cases."

Throughout the pandemic, hanging onto those customers has been a priority for Lemonade. As millions of Americans face evictions stemming from job losses and being unable to pay rent, Lemonade has sought ways to accommodate those customers so they can remain covered.

"In many cases, [Lemonade] is more important than ever," Bixby said. "People are at home, and they want to do anything they can to protect the things that are important to them, whether it's belongings, whether it's their home itself, or even a pet."