From Wall Street to Silicon Valley, these are the top stories that moved markets and had investors, business leaders, and entrepreneurs talking this week on Cheddar.

TECH ROLLERCOASTER

It was a roller coaster of a week for tech stocks. After continuing a weeks-long rally, the momentum abruptly reversed on Thursday, with the tech-heavy Nasdaq losing 5 percent — led by high-flying stocks like Apple and Tesla coming, at least momentarily, back down to Earth. Both of those companies opened the week with stock splits — 4-for-1 for Apple, 5-for-1 for Tesla — which had the effect of pouring even more fuel on the rally, until it finally ran out of steam. The losses continued on Friday with the major indexes just falling short of a comeback bid before close.

Of all the tech names that have become poster children for the pandemic economy, perhaps none was more apparent than Zoom. The videoconference software company released earnings on Tuesday that were even more astounding than the expectations: revenue for the quarter surged 355 percent, with EPS coming in at more than twice the estimate. Zoom CEO Eric Yuan’s stake in the company he founded nine years ago skyrocketed to $20 billion.

LABOR MARKET

U.S. employers added 1.4 million jobs in August, roughly in line with economists’ estimates and further evidence that the recovery will continue to be drawn out over the months to come. The August jobs report did have the effect of shaving nearly two full points off the official unemployment rate, which now stands at 8.4 percent. The job gains were less than the 1.7 million in July and 4.8 million in June, and payrolls remain well below where they were before the pandemic took hold in March. The 1.4 million jobs added included about a quarter-million temporary workers hired by the Census Bureau, who will be laid off when counting ends in the coming weeks.

WALMART V. AMAZON

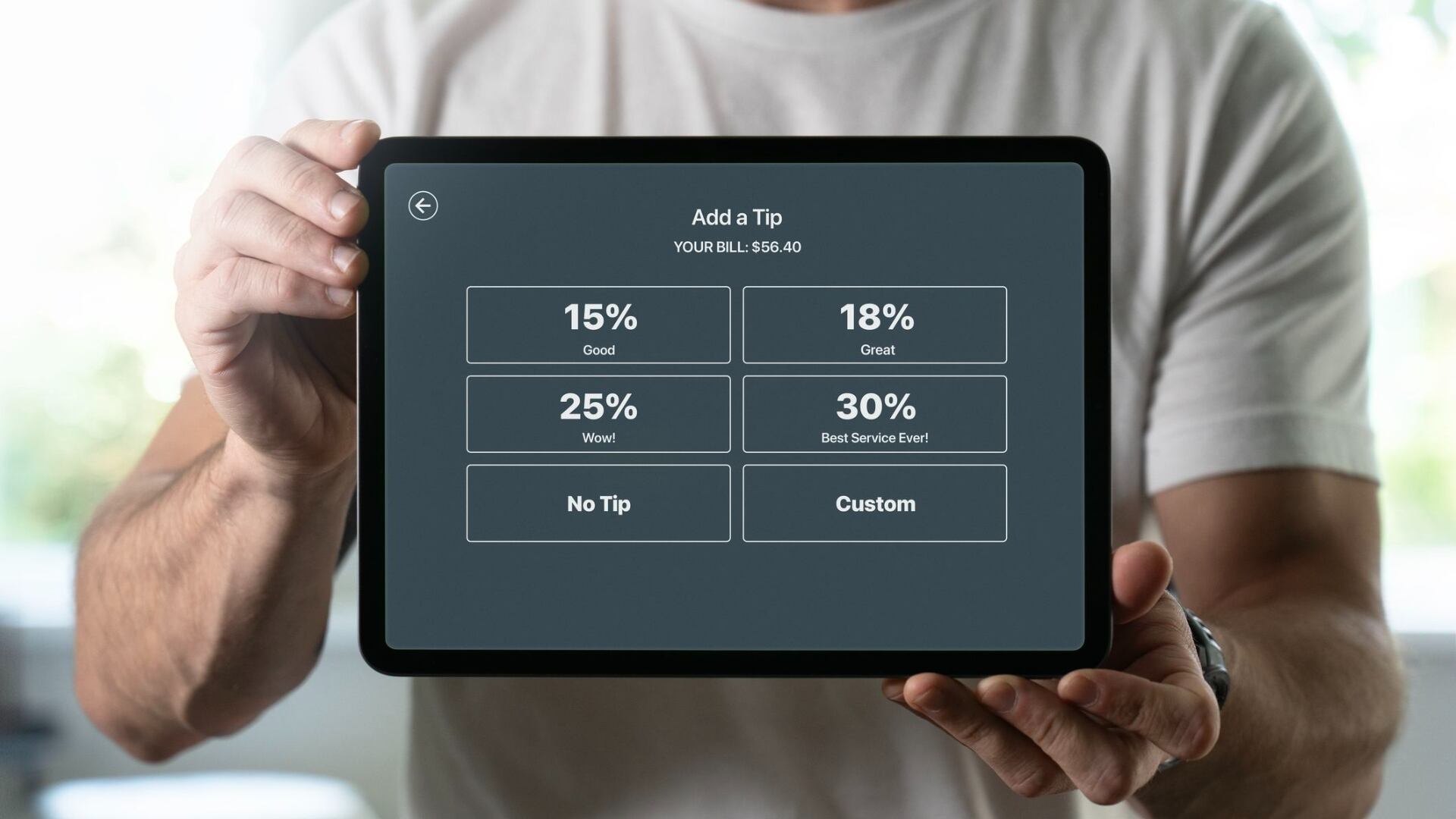

Walmart is taking its biggest step yet to compete head-on with Amazon, announcing the launch of its first annual membership program. Walmart Plus costs $98 per year — slightly cheaper than Amazon Prime — and includes perks like free shipping and same-day delivery on some orders, discounts on gas, and cashierless checkout through the app for in-store purchases. The program is an expansion of Walmart’s successful test of grocery delivery, which accelerated once the virus hit. Unlike Amazon, Walmart doesn’t have to build out huge warehouses to fulfill orders; it already has them in the form of its 5,000 U.S. stores. Analysts expect that business model to help the big-box compete with Prime, but it will still have a long way to go — Amazon Prime counts more than 150 million members in the U.S. Walmart Plus launches on Sept. 15.

ELECTION INTEGRITY

Facebook will ban all new political advertising during the week before Election Day, its biggest move yet in an attempt to suppress misinformation and interference from President Trump and others. The social network will also take down posts that attempt to dissuade people from voting and flag posts from any candidate claiming a premature victory. The Trump campaign called the move to suspend political ads an attempted silencing by the “Silicon Valley mafia” even though it will apply to all candidates and PACs. In interviews this week, Facebook CEO Mark Zuckerberg said he’s worried about “civil unrest” after the election, especially if votes take longer than usual to be counted because of a surge in mail-in ballots.

APPLE PRIVACY UPDATE

Apple is delaying a change to its iPhone software that would give users the chance to opt in or out of data tracking on an app-by-app basis. That change had Facebook as well as smaller app makers worried that it will hurt their ability to serve targeted ads. Facebook complained that the opt-in prompt, which many users would likely deny, could wipe out as much as half of its ad revenue. Apple says it’s punting the update until early next year.