The pandemic has changed how we socialize, how we purchase things, how we move goods, and certainly how we think about public health, to name just a few examples.

But part and parcel of all these developments is the role of money, which has undergone its own evolution over the past two years.

The economic impact of the virus has led to new questions about how money works, what it can buy, and who should manage it at the center of our lives, from the explosive rise of cryptocurrencies to ways of thinking about public spending.

Cheddar looked back at Year Two of the pandemic to provide a breakdown of the biggest trends impacting money and what they could mean for 2022.

The Great Inflation Debate

One of the most widespread, and for some, painful changes to money in 2021 was that it bought less.

The return of high inflation after a four-decade hiatus came as a shock in March, when the consumer price index tipped above the 2 percent mark, which was the upper limit for much of the last decade. Since then, inflation measures have shown a steady month-over-month rise in prices, with the latest CPI data from November showing a nearly 7 percent hike, the biggest annual increase since 1982.

The inflation data quickly sparked off a debate that continues to this day: what's causing this inflation, how long will it last, and what should we do about it.

Those who argue that recent inflation is largely transitory — the result of pandemic-related supply chain issues — have called for patience, but those who blame high government spending and the Fed's easy money policies for inflation have called for a combination of austerity and monetary tightening.

The stakes of this debate are potentially huge. The Federal Reserve is trying to balance its dual mandate of controlling inflation with helping the economy reach full employment, goals that could prove at odds with each other in the coming year as the central bank readies itself for rate hikes that could jeopardize the recovery.

The Biden administration, meanwhile, is trying to push through a $1.7 trillion spending package that proponents argue is crucial for the economic recovery, while critics fear it could further fuel inflation.

With no resolution yet on the future of the package, or a clear signal of what exactly the Fed plans to do, this debate is likely to roll right into 2022.

The Rise of Decentralized Finance

In March, at the same time that inflation started kicking in across the economy, the price of Bitcoin was hitting what was then an all-time high of nearly $60,000. The price rally that had begun in 2020 really started ratcheting up in the first quarter of 2021, and with it came a tidal wave of crypto enthusiasm.

Other leading cryptos such as Ethereum, Cardano, and Solana rode the wave as well, which has given rise to the decentralized finance, or defi, ecosystem.

It's this latter category of cryptos that are already having an impact on the world of money. While Bitcoin remains largely a speculative asset for adventurous investors, many defi applications aim to reinvent every major aspect of the financial system, from banking to payments to lending and borrowing.

These cryptocurrencies' underlying blockchains are increasingly serving as the launchpad for other financial applications, and while most of them have yet to go mainstream, defi is becoming one of the main selling points for crypto adoption. Open the doors to defi, proponents say, and financial innovation will follow.

Unsurprisingly, decentralized finance has also gotten the attention of lawmakers and regulators, who are concerned about the lack of regulation in the space. In particular, they have started looking into the use of stablecoins — cryptocurrencies that are pegged to the price of an underlying asset, in most cases a fiat currency like the U.S. dollar — which are themselves still unregulated.

What regulators ultimately do about these concerns could fundamentally alter prospects for the defi space, but for the moment, it's growing at a breakneck pace.

New Ways to Pay

Even as defi remains on the margins of economic life, other financial startups outside of the crypto world are shaking up how customers pay for things.

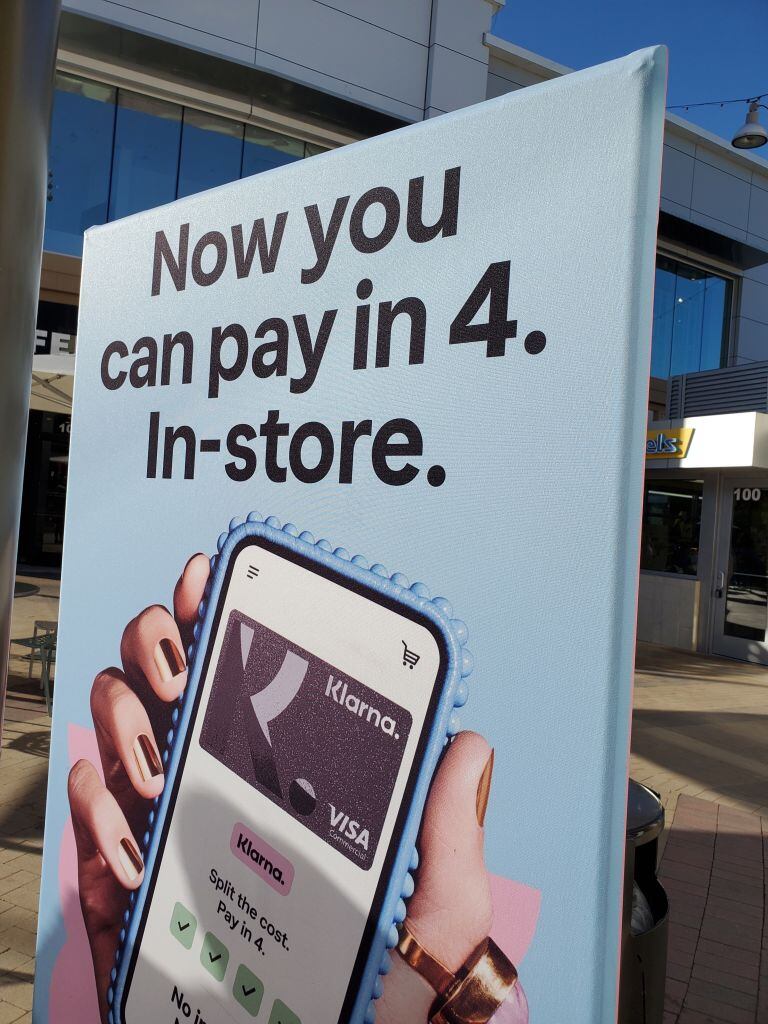

Hot off the more intensive COVID restrictions of 2020, contactless and digital payments continue to penetrate the retail sector. But more unique to 2021 was the rapid rise of deferred payment platforms, also known as "buy now, pay later" (BNPL).

Companies such as Affirm, Klarna, Uplift, and Splitit offer customers the chance to pay for items in multiple installments at no interest and few barriers to access.

These apps have proliferated across retailers — particularly e-commerce sites — throughout the year. Even Amazon now allows customers to use these services.

While the industry has found itself recently under some regulatory scrutiny, with a focus on the potential risks to consumers, the model only appears to be expanding.

MMT Has Its Moment

A million years ago, when Biden's infrastructure package was the latest mega-bill grabbing headlines out of Washington, DC, an interesting discussion swirled around how the new administration planned to pay for it.

As lawmakers debated new taxes, others noted something that had become increasingly apparent to a growing number of economists: government spending really didn't depend on tax revenues anymore. For years, the federal government has effectively funded itself with Treasury bonds, and when the Federal Reserve started buying these bonds in bulk after The Great Recession, it became even more clear that the old model of tax-and-spend was long outdated.

Growing awareness of this new state of affairs gave credence to what's called "modern monetary theory" in academic circles. This is the idea that governments that have monetary sovereignty (i.e. the ability to print their own currency) can effectively spend whatever they want regardless of tax revenues.

According to this theory, the main purpose of taxation then is to control inflation, which is the only real curb on government spending. With the pandemic leading to a massive increase in federal spending, the theory had serious appeal to those who wanted to see the U.S. shed its old hang-ups about going over budget.

While the Biden administration ultimately didn't embrace the theory publicly — and did, on paper at least, find funding sources for the bipartisan infrastructure package that eventually passed — MMT has become a regular part of the discourse around public spending, with a growing number of progressive Democrats invoking the theory to justify a more active federal government.

With that particular economic insight now out of the bag, it's unlikely to go away anytime soon, as fundamental questions about public spending, debt, and inflation loom larger than ever.