It didn't take long for hackers to turn their focus on the newest streaming player in the game: Disney+.

The streaming service launched last week to a better-than-expected 10 million sign-ups by the end of the first day. But the technical difficulties many users faced at launch was only the first issue subscribers began to face.

Soon after, thousands of accounts were reportedly posted on Reddit and hacker forums. Disney+ users flocked to Twitter and Reddit to complain. Some say Disney did not secure the accounts well enough.

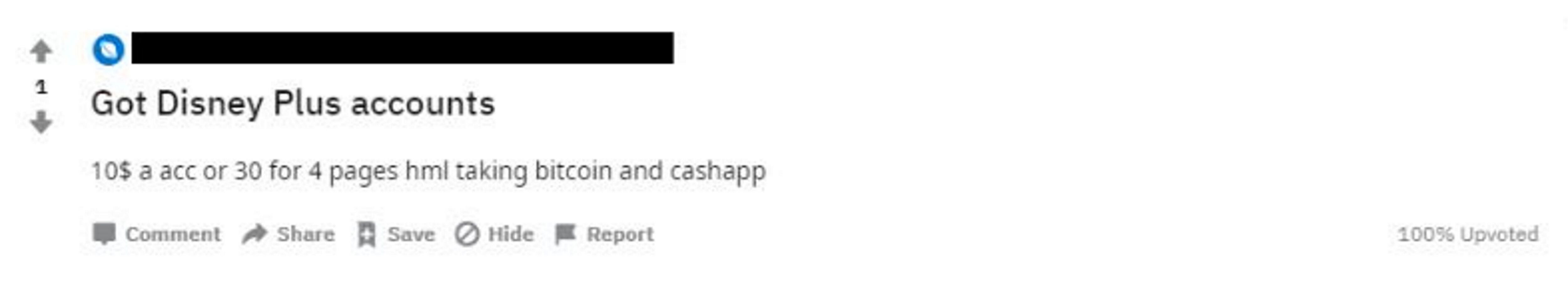

Disney+ accounts, which costs $7 a month, are being sold on forums for a single charge of $3 to $11. Hackers have posted some accounts for free. Technology news site ZDNet, which spoke with users who said their accounts had been hacked, reported some were posted for sale just hours after the service launched.

Users discovered the problem when they had trouble logging into their accounts and found their email addresses and passwords had been changed, locking them out. Others reported unauthorized profiles in their accounts.

When subscribers began to realize their accounts had been compromised, some users reportedly waited for hours to speak with customer service representatives.

Currently, Disney does not allow profiles to be deleted. Disney+ account holders are being advised to create unique passwords, but it is not yet clear how the company will protect accounts moving forward amid complaints about the service's security.

A Disney spokesperson said in an email that "there is no indication of a security breach on Disney+."

Karen Hobson, senior VP of Corporate Communications for Disney, said the "incidents most likely occurred as a result of an unauthorized individual re-using a customer’s email/password combination gathered during previous security incidents impacting other companies."