Venmo is adding extra security checks to help users confirm they're sending money to the right person while maintaining their privacy.

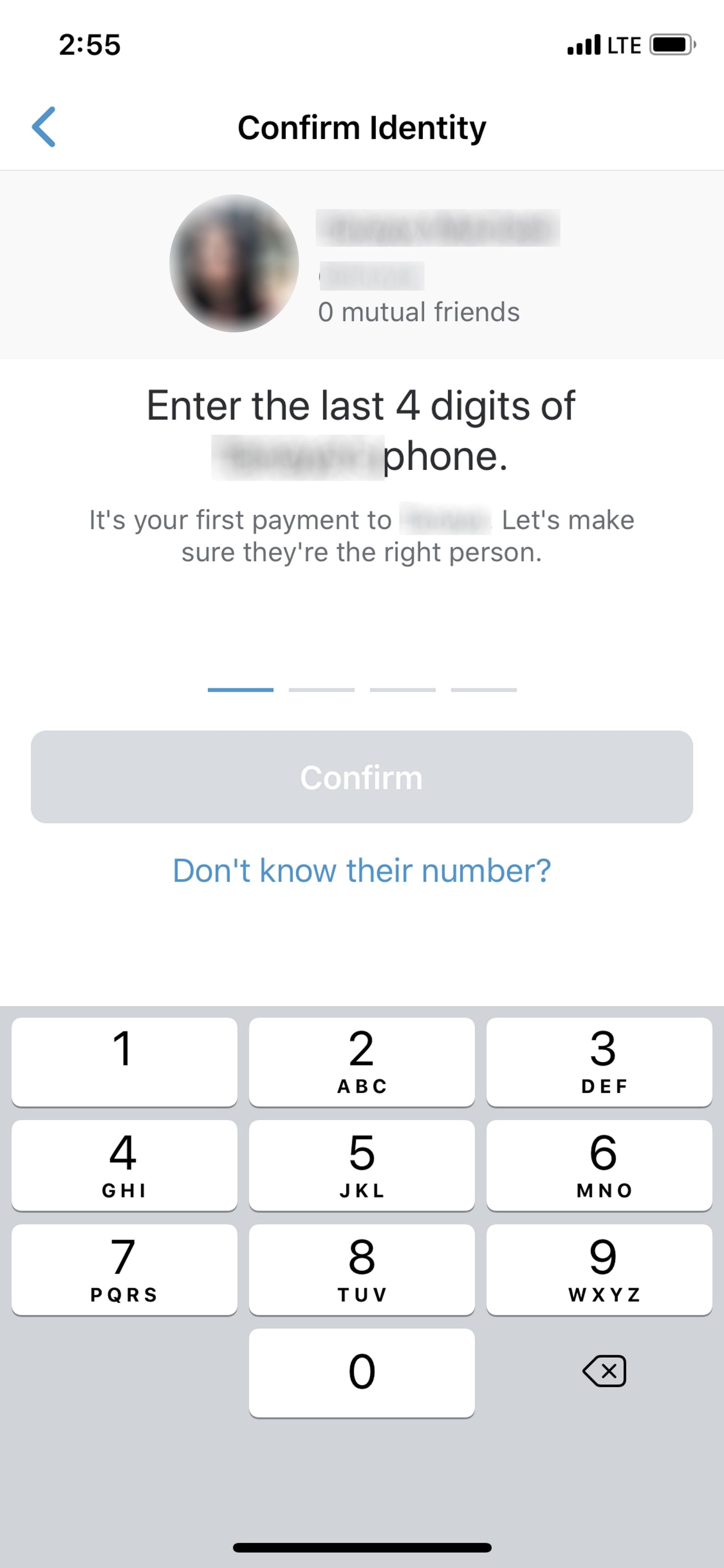

The PayPal-owned, hugely popular person-to-person payment app is testing a feature that prompts senders to enter the last four digits of the intended recipient's phone number if the two aren't in each other's networks or haven't exchanged money before.

Currently, users need only a handle, phone number, email, or QR code to initiate a payment, but this added security measure would help users make sure they're sending money to the intended recipient.

"Venmo is constantly working to identify ways to refine and enhance the user experience," said a Venmo spokeswoman, who declined to comment further to Cheddar on the update.

"We are testing some features focused on enhancing security in order to understand the value it could have for our users."

Banks don't have any visibility into what takes place in any third-party app once users transfer funds out of their bank accounts. And if fraudulent activity is taking place, it isn't clear who's liable for it. P2P payment services, including Venmo and Square's Cash App, have received criticism for the opacity on the issue.

"In Venmo it's really easy to accidentally send money to the wrong person," said Lisa Ellis, an analyst at MoffettNathanson. "How do you validate the person you're sending money to? Individuals can easily fat finger it, and they send money to the wrong person all the time."

That issue is important for competing services too, not just Venmo, Ellis added. There's often a misperception in P2P payments that because the user pushes the payment, it is inherently secure, but it makes individuals more vulnerable to identity-related fraud and scams. (By contrast, when someone pays for something with a debit or credit card, the merchant's bank makes a request for the money from the customer's bank account, so the payment flow works in the opposite direction.)

According to an S&P Global Market Intelligence report, security and reliability are the second-largest hindrances to mobile payments adoption across several use cases including P2P payments.

Venmo is clear in the app and on its website that it's designed for payments "between friends and people who trust each other," that those payments could be high risk, and that Venmo doesn't offer protection for buyers or sellers. But PayPal wants to make the popular app just as ubiquitous and mainstream as its core PayPal ($PYPL) brand, and it'll have to start adjusting its various security and privacy elements to accommodate that, said Nimayi Dixit, a research analyst at S&P Global Market Intelligence.

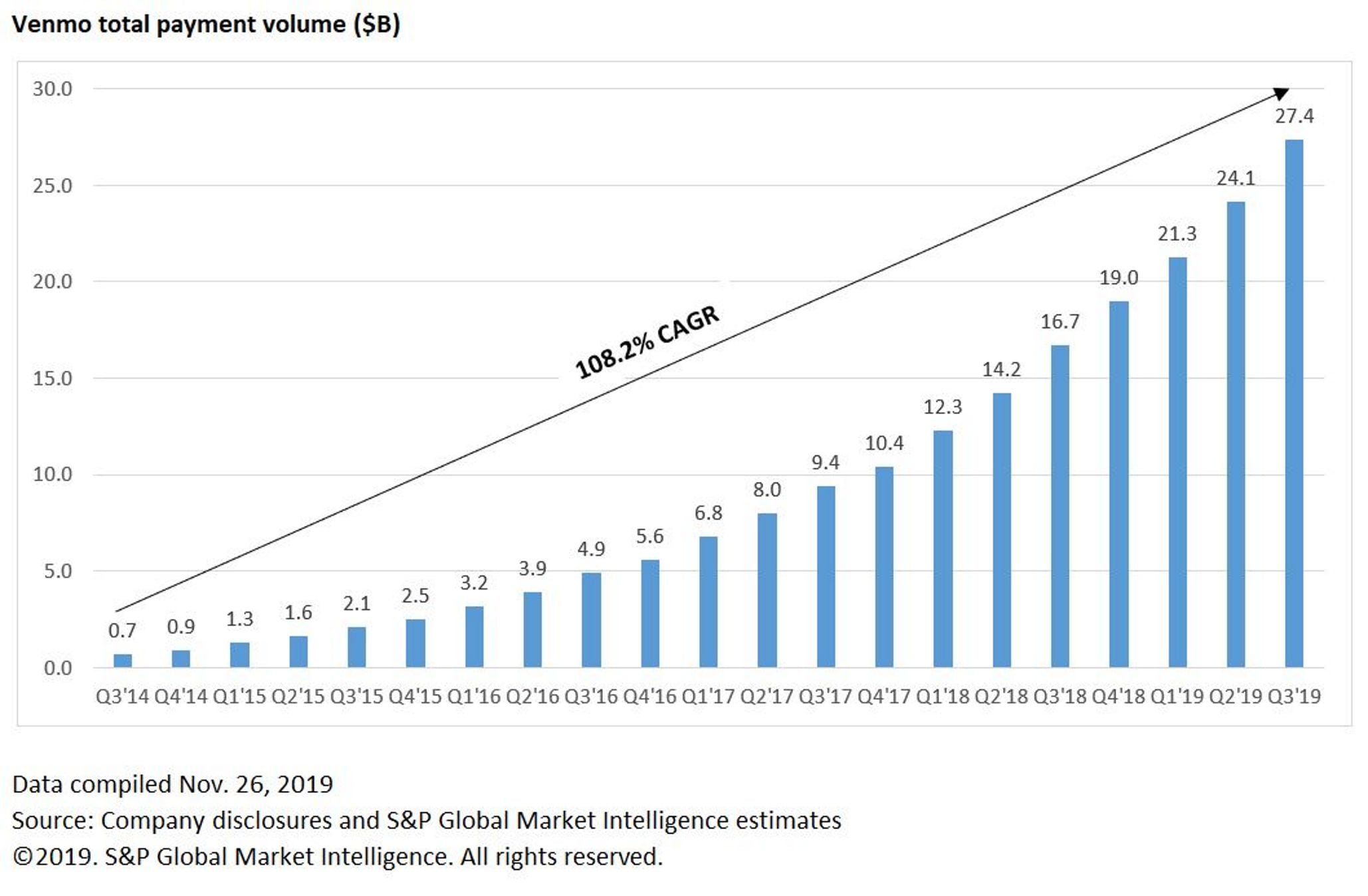

"Tightening up security and the claim that you have these secure processes will be important to get those non-users on board," he told Cheddar. "If you want to keep heavy growth rates going, you have to get nonbelievers on board."

Venmo processed $27.4 billion in the third quarter of 2019, up from to $16.7 billion the same quarter a year ago and $9.4 billion in Q3 2017. (By comparison, PayPal processed $179 billion in the third quarter of this year.)

The app has been a financial drain on PayPal, which acquired it in 2013 through its acquisition of Braintree because Venmo doesn't charge most users to move money. (Venmo charges a 1 percent fee for instant transfers, with a minimum fee of $0.25 and a maximum fee of $10.) Venmo added a revenue stream with the launch of its debit card in 2018, and it plans to launch its first credit card next year. Last week it acquired the automated coupons platform Honey, whose features it could integrate into Venmo to create a discovery shopping experience like that of Pinterest.

The more mainstream the Venmo usage becomes, the less likely it'll remain an app for true friend-based P2P payments. The service has already expanded to let users pay approved merchants, and has reached eponym status amongst millennials, many of whom use "Venmo" as a catchall verb when referring to digital payments. Company execs have said they see an opportunity to let users Venmo gym trainers, dog walkers, babysitters, and other regular P2P service providers. The company is reportedly also pushing in-store PayPal and Venmo payments next year, CEO Dan Schulman said earlier this month.

Larger transaction volume is also starting to grow, and P2P payments aren't just for college kids splitting a dinner bill anymore. For the bank-owned P2P payments network Zelle, for example, rent has become the number one transaction use case, according to company data.

"As people who started using Venmo in high school or college grow older they'll start to spend their money on services that are higher ticket items and will have a higher degree of comfort using P2P, whereas older generations might cut a check," Dixit said.