Stocks on Wall Street closed broadly lower Monday as the White House stepped up pressure on major trading partners to make deals before punishing tariffs imposed by the U.S. take effect.

The S&P 500 fell 0.8% for its biggest loss since mid-June. The benchmark index remains near its all-time high set last week.

The Dow Jones Industrial Average gave back 0.9%. The Nasdaq composite also finished 0.9% lower, not too far from its own record high.

The losses were widespread. Decliners outnumbered gainers by nearly 4-to-1 on the New York Stock Exchange.

Tesla tumbled 6.8% for the biggest drop among S&P 500 stocks as the feud between CEO Elon Musk and President Donald Trump reignited over the weekend. Musk, once a top donor and ally of Trump, said he would form a third political party in protest over the Republican spending bill that passed last week.

The selling accelerated after the Trump administration released letters informing Japan and South Korea that their goods will be taxed at 25% starting on Aug. 1, citing persistent trade imbalances with the two crucial U.S. allies in Asia.

“If for any reason you decide to raise your Tariffs, then, whatever the number you choose to raise them by, will be added onto the 25% that we charge,” Trump wrote in the letters to Japanese Prime Minister Shigeru Ishiba and South Korean President Lee Jae-myung.

Trump also announced new tariff rates on Malaysia, Kazakhstan, South Africa, Laos and Myanmar.

Just before hefty U.S. tariffs on goods imported from nearly every country around the globe were to take effect in April, Trump postponed the levies for 90 days in hopes that foreign governments would be more willing to strike new trade deals. That 90-day negotiating period was set to expire before Wednesday.

On Sunday, Trump said he would impose an additional 10% in tariffs against the BRICS bloc of developing nations, which had condemned tariffs increases at its summit in Brazil. In addition to Brazil, the BRICS countries also include Russia, India, China and South Africa.

This latest phase in the trade war heightens the threat of potentially more severe tariffs that’s been hanging over the global economy. Higher taxes on imported goods could hinder economic growth, if not increase recession risks.

“Just bringing back that meaty topic back into focus, after a strong week last week, has given a little bit of a pause in the market,” said Bill Northey, senior investment director at U.S. Bank Asset Management.

The near-term outlook will likely hinge on several key factors like the extent to which trading partners are included in Trump letters, the rate of tariffs, and the effective date of such tariffs, according to analysts at Nomura.

Last week, the Trump administration announced that it reached a deal with Vietnam that would allow U.S. goods to enter the country duty-free, while Vietnamese exports to the U.S. would face a 20% levy. That was a decline from the 46% tax on Vietnamese imports he proposed in April.

“The type of deal struck with Vietnam may be a blueprint for similar countries in the region with economies heavily reliant on large trade deficits with the U.S.,” said Jason Pride, chief of investment strategy and research at Glenmede.

Monday’s market sell-off came on the first day of trading in the U.S. after a holiday-shortened week.

Nearly all of the sectors in the S&P 500 index closed in the red, with technology, financial and consumer-related stocks among the biggest weights on the market.

Apple fell 1.7%, JPMorgan Chase dropped 1.4% and Home Depot slid 1.1%.

Molina Healthcare fell 2.9% after the insurer lowered its profit guidance due to rapidly accelerating costs. UnitedHealth Group also recently reported a spike in costs that forced it to cut its forecast, sending its stock tumbling in April.

In deal news, software company CoreWeave agreed to acquire cryptocurrency mining company Core Scientific in an all-stock transaction valued at about $9 billion. Shares in Core Scientific sank 17.6%, while CoreWeave fell 3.3%.

Bond yields mostly rose. The yield on the 10-year Treasury rose to 4.39% from 4.34% late Thursday.

The downbeat start to the week follows a strong run for stocks, which pushed further into record heights last week after a better-than-expected U.S. jobs report.

All told, the S&P 500 fell 49.37 points to 6,229.98. The Dow lost 422.17 points to 44,406.36, and the Nasdaq slid 188.59 points to 20,412.52.

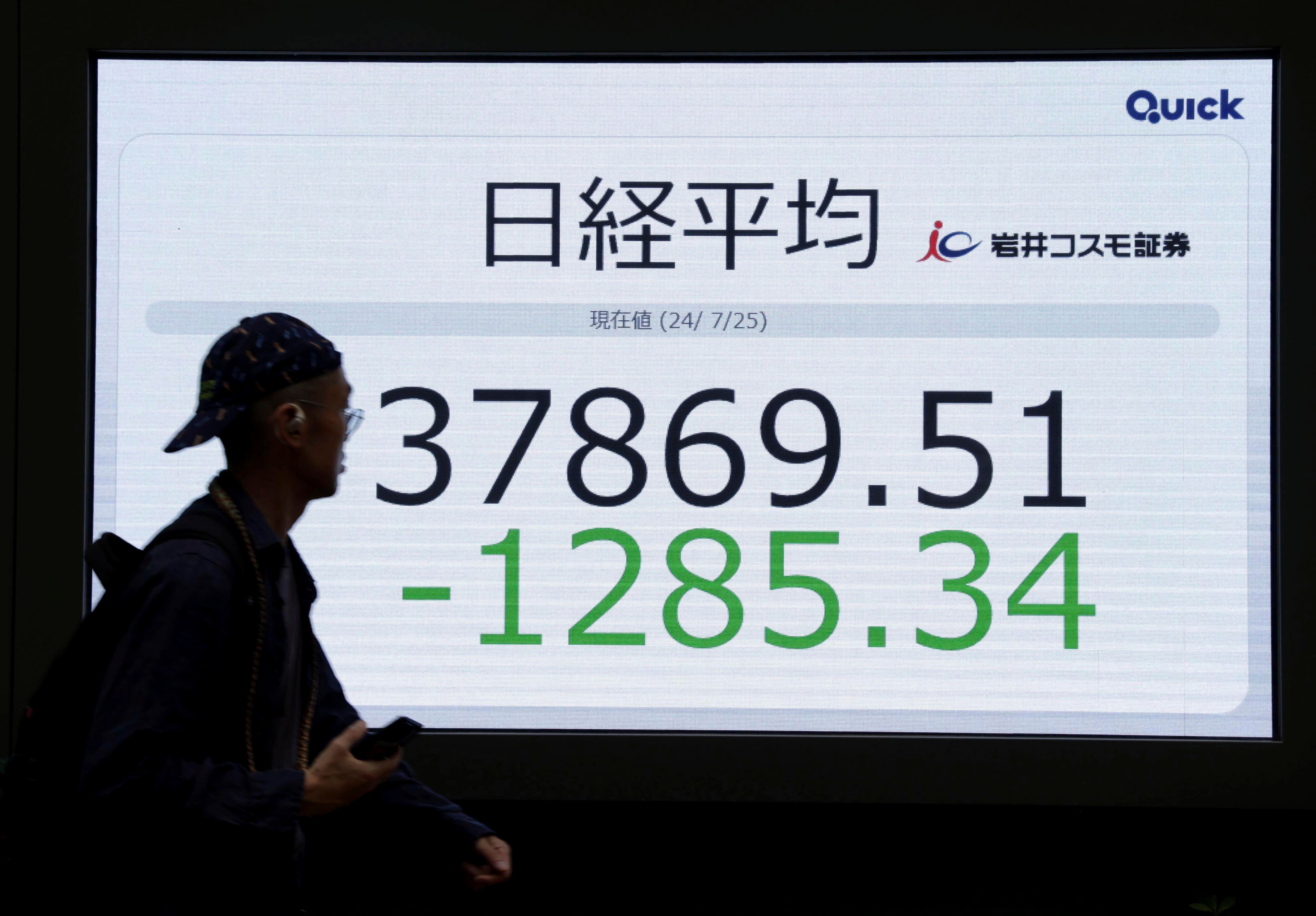

Stock indexes in Europe ended mostly higher. Asian markets closed mostly lower.

Oil prices fluctuated after OPEC+ agreed on Saturday to raise production in August by 548,000 barrels per day.

U.S. benchmark crude settled 1.4% higher at $67.93 per barrel, while Brent crude, the international standard, rose 1.9% to settle at $69.58 per barrel.

This week will be relatively light on economic data. On Wednesday the Federal Reserve will release minutes from its policymaking committee’s meeting last month.

The Fed’s chair, Jerome Powell, has been insisting that the central bank wants to wait and see how Trump’s tariffs affect the economy and inflation before making its next move on interest rates. While lower rates give a boost to the economy by making it easier to borrow money, they can also give inflation more fuel. That could be dangerous if the Trump administration’s tariffs send inflation higher.