Despite November's jobs report falling well below what Wall Street had been expecting, Trump administration officials are defending the resilience of the American economy.

"The underlying details are actually quite good," Joe LaVorgna, Chief Economist for the White House National Economic Council, told Cheddar a few hours after the report's release.

"This recovery is not faltering. It's certainly not faltering on fundamentals," he also said.

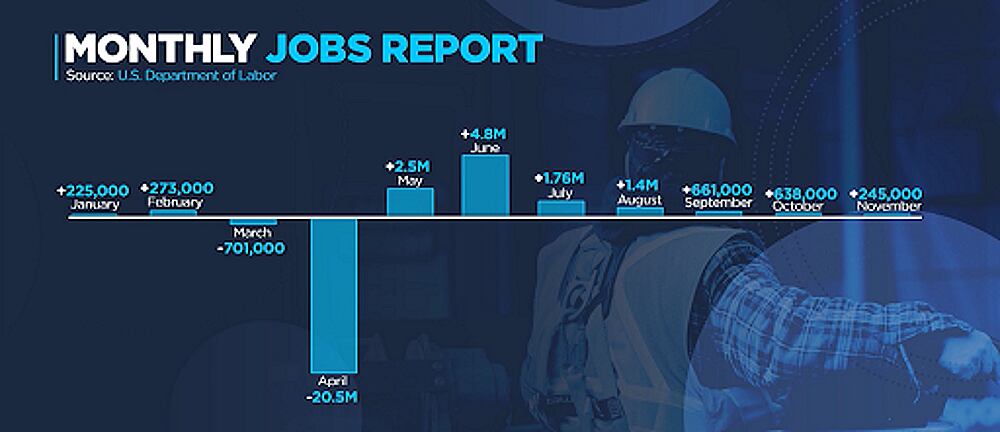

The report released Friday showed that just 245,000 jobs were added in November, which is lower than the last pre-pandemic jobs report that showed 273,000 jobs added in February.

However, LaVorgna pointed out the unemployment rate dropped from 6.9 percent in October down to 6.7.

"We all look at the unemployment rate, including [Wall Street]," LaVorgna said. "Estimates back in the summer were that rates would go up to near 20 percent. We're down 54 percent on the unemployment rate since where we were back in April."

While the White House is correct in calling out wildly missed forecasts by Wall Street economists, roughly 5.5 million Americans are still filing for continuing unemployment benefits. LaVorgna says the White House and Republicans are interested in providing more assistance, but he thinks the economy isn't as dire as many people make it out to be.

"We'd like to get people assistance. We're not resting on our laurels," LaVorgna said. "However, as we've argued all along, this economy is much stronger than people think."

A recent $908 billion bipartisan proposal has gained momentum with Democrats in Congress, but Republican Senate Majority Leader Mitch McConnell appears to be focused on a smaller Republican proposal. Still, McConnell says he's confident that the two sides can reach a deal soon.

LaVorgna says that the White House and Republicans may have given up too much when the CARES Act was hurriedly passed in April, and implied that additional stimulus isn't entirely necessary.

"We believe we went more than halfway with our colleagues on the other side of the aisle," LaVorgna said. "Negotiations are still going on. We'll see what comes of it."

In a statement Friday, President-elect Joe Biden expressed deep concern about the jobs numbers and the need to get a stimulus deal done before December 31, when CARES Act money runs out.

"This is a grim jobs report. It shows an economy that is stalling," Biden's statement read. "Congress and President Trump must get a deal done for the American people."

LaVorgna says 'Trumpian' economic policies are why America's recovery surprised so many experts on Wall Street.

"To me, there's been way too much pessimism out there," LaVorgna said.

I'm an optimist. I think there's been good reason for me to be optimistic."