As voters weigh the candidates’ various proposals heading into the 2020 presidential election, issues around higher education and mounting national student loan debt are factors many are considering before casting a ballot.

Currently, more than 40 million Americans have student loan debt, and collectively they owe the federal government $1.5 trillion. In a poll conducted by Cheddar, 12 percent of prospective voters said they defaulted on their loans with another 8 percent in danger of doing the same.

A Brookings study found that approximately 40 percent of student loan borrowers are expected to default by 2023. The financial strain, particularly in a year where the COVID-19 crisis has piled up hospital bills for many families, has moved student debt planning higher up on the list of critical voting concerns.

Plans for higher education

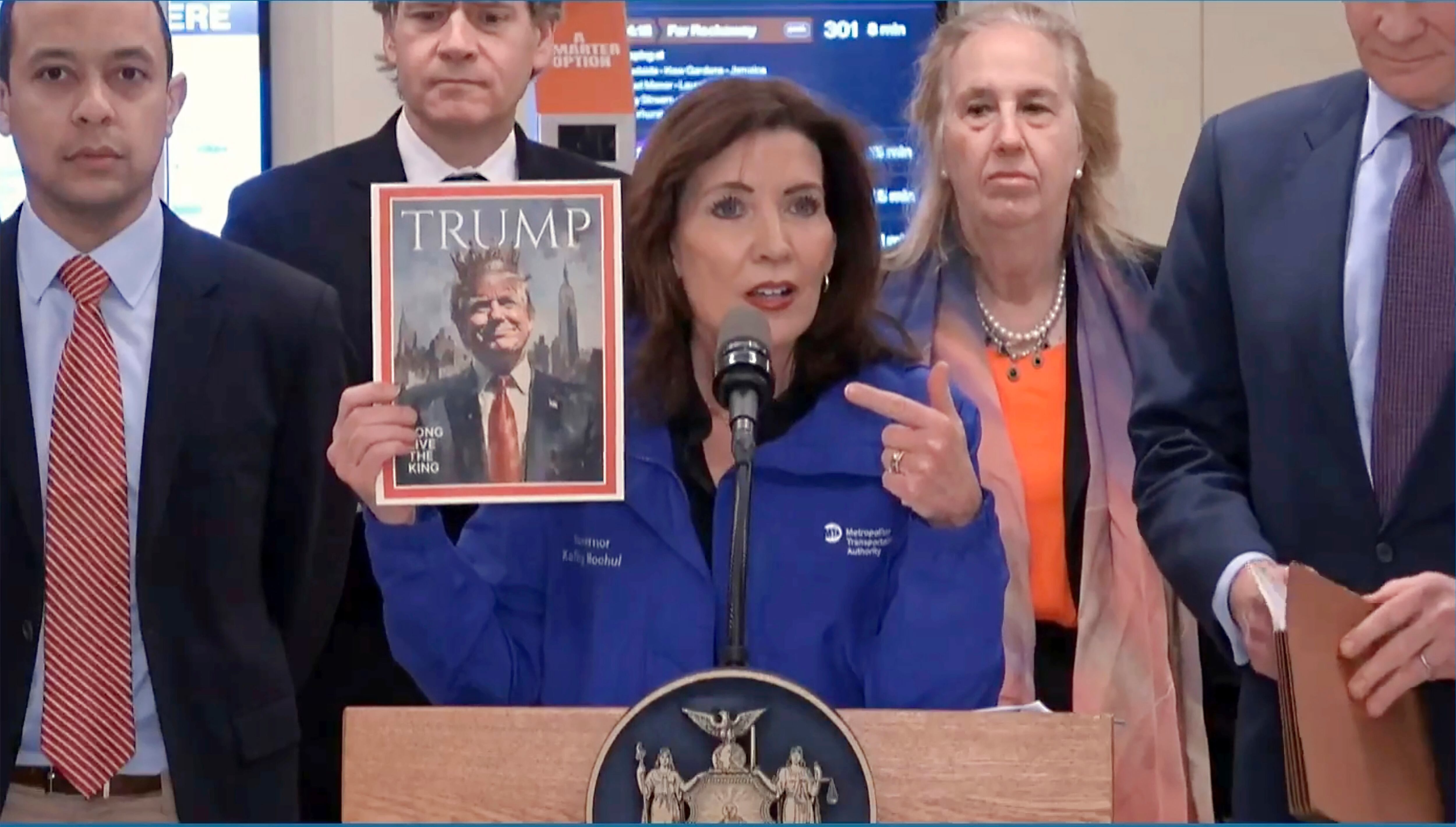

The Trump administration so far has rolled out the College Scorecard, a tool for prospective college students to navigate the cost of various schools, the earning potential based on major, and secondary higher education options, like apprenticeships. The president largely views higher education as a consumer-driven marketplace.

While federal spending under Trump has reached landmark levels, he plans to slash funds for higher education by $170 billion. The cut would effectively limit access to students in need of financial aid, but the president has shown some flexibility on Pell Grants for lower-income families. Access to government-subsidized loans would also end, leaving those still in school or facing an economic fallout to cover interest fees.

Joe Biden, meanwhile, has a plan to cancel student debt for millions of qualifying students. Those who attended public universities, historically Black colleges and universities, or minority-serving institutions would have their loans wiped out. He also has said that attending public universities should be free for low and middle-income students.

Students from families making less than $125,000 annually would also have their obligations forgiven.

Read More on Trump and Biden's Plans: