From Wall Street to Silicon Valley, these are the top stories that moved markets and had investors, business leaders, and entrepreneurs talking this week on Cheddar.

MARKET ROLLERCOASTER

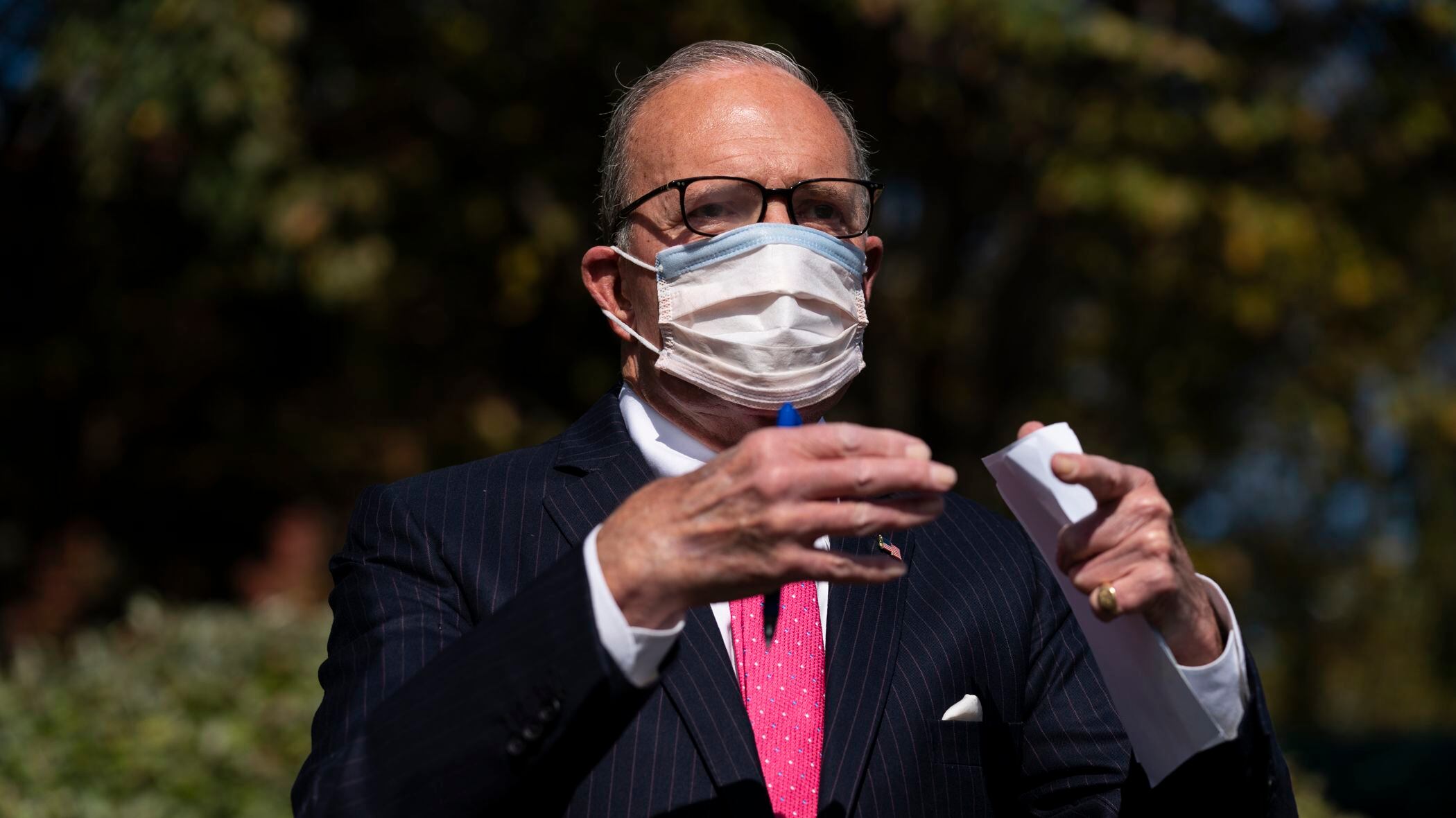

Will they or won’t they? Investors were once again taken for a rollercoaster ride over the status of negotiations in Washington over a potential new fiscal stimulus deal. President Trump, still recovering from COVID-19, sent markets plummeting early in the week when he announced that he had called off any new deal until after Election Day. Then there was talk of a narrow bill to address the airline industry, then reports on Friday that the White House was now gung-ho on reaching a new agreement as soon as possible. The markets ended up on Friday closing out their best week since July despite the ups and downs .

COVID THERAPEUTICS

Shares of Eli Lilly and Regeneron spiked after President Trump said an experimental antibody cocktail made by the latter that he received in the course of his treatment made him feel better “immediately.” Trump said he would make antibody cocktails made by both Eli Lilly and Regeneron free “especially if you’re a senior.” While neither of these experimental treatments are “cures,” as the president misleadingly said, they are among the most promising of the COVID therapeutics currently in the pipeline. After the president’s comments, Regeneron announced it would seek an emergency approval from the FDA for its drug.

FACEBOOK & THE ELECTION

Facebook took new actions to guard against misinformation and conspiracy theories related to the election. The social giant has banned all political, electoral, and social-issue advertising across the platform when polls close on Nov. 3 in order to “reduce opportunities for confusion or abuse” -- such as one candidate declaring victory prematurely. Political and media analysts were quick to note that the move would do nothing to stop the spread of any kind of misinformation organically through Facebook’s algorithms, so long as it isn’t a paid advertisement. Separately, Facebook has finally banned all QAnon accounts and groups across the site, a significant escalation in the company’s attitude toward moderation of false and potentially dangerous content.

BIG TECH REGULATION

More than a few commentators noted that Facebook’s new policies came as the regulatory landscape for the so-called Four Horsemen of Tech — Apple, Amazon, Facebook, and Google — appears to be shifting. House Democrats this week released the results of their 16-month investigation into Big Tech, the most significant legislative effort to rein in the technology sector since the government tried to break up Microsoft in the late 1990s. The report, which would take on even more significance in the event of a Democratic sweep of government next month, called for steps to be taken to restructure antitrust laws in order to check the growth and influence of Apple, Amazon, Facebook, and Google, with a particular focus on the latter two. Shares of those companies wobbled on the news but then largely recovered to end the week.

MARQUEES STAY DARK

The movie industry stopped in its tracks last weekend over the news that Cineworld, parent of Regal, planned to temporarily close all theaters in the U.S. and UK after the new James Bond movie was delayed — again — until next April. Cineworld said there just aren’t enough new releases to justify staying open, especially with major markets like NYC still closed. Even where theaters have reopened, the box office has not rebounded anywhere close to where it needs to be to ensure exhibitors don’t go out of business without help from the government. Still, AMC said it would keep its theaters open where state and local guidelines allow, pointing to the revenue-sharing agreement it made with Universal over the summer as one of the reasons that put it in the position to keep operating.